5 Salesforce Analysts Break Down Q1 Beat: 'Executing On Improving Growth And Margins'

Shares of Salesforce.com, inc. (NASDAQ: CRM) jumped 5.43% on Friday after the company reported accelerating growth in the first quarter and issued impressive full-year guidance.

On Thursday afternoon, Salesforce reported first-quarter EPS of $1.21 on revenue of $5.96 billion. Both numbers topped consensus analyst estimates of 88 cents and $5.89 billion, respectively. Revenue was up 23% from a year ago.

Related Link: Nordstrom Shares Pull Back After Q1 Earnings: What Do Analysts Think?

Salesforce reported $1.75 billion in revenue in its Platform and Other segment, up 28%. The company’s core Sales Cloud segment delivered $1.39 billion in revenue, up 11%.

Looking ahead, Salesforce guided for second-quarter EPS of between 91 cents and 92 cents on revenue of between $6.22 billion and $6.23 billion, beating analyst expectations on both fronts.

The company also exceeded full-year fiscal 2022 guidance expectations, calling for between $3.79 and $3.81 in EPS and between $25.9 billion and $26 billion in revenue on the year.

Salesforce Analysts On Growth, Margins: Morgan Stanley analyst Keith Weiss said Salesforce is “executing on improving growth and margins.”

“Salesforce reported cRPO growth of 23% YoY to $17.8 billion, well ahead of consensus estimates of $17.3 billion (+19.3% YoY),” Weiss wrote.

Raymond James analyst Brian Peterson said bears may criticize the low-quality earnings beat, but he is encouraged that Salesforce’s recent acquisitions are driving more large deal activity.

“We're cognizant that investors continue to ask for margin expansion, although it's hard to find a more compelling risk/reward in software for a company delivering 20%+ growth at this scale,” Peterson wrote.

Piper Sandler analyst Brent Bracelin said Salesforce’s record first-quarter operating margin of 20.2% was impressive, and its updated guidance for 19% organic revenue growth this year was a particularly bullish development.

“This material uptick from the initial outlook of 17% reaffirms that enterprise adoption of the CRM multi-cloud strategy is resonating with enterprise customers,” Bracelin wrote.

Salesforce's Slack Acquisition Looms: Roth Capital Partners analyst Richard Baldry said investors should be prepared for significant revenue and earnings growth dilution in the second half of fiscal 2022 following the acquisition of Slack Technologies Inc (NASDAQ: WORK).

“We still view Salesforce's choice to pay roughly $28B or 28x run-rate revenues to acquire Slack as impossible to defend on financial terms,” Baldry wrote.

Needham analyst Scott Berg said Salesforce’s first-quarter numbers were solid, but he’s skeptical of the company’s ability to grow margins over time.

“We temper our enthusiasm until the company shows a multi-quarter follow-through especially as T&E expenses re-enter the model in 2H,” Berg wrote.

Salesforce Ratings, Price Targets:

- Roth Capital Partners has a Neutral rating and $200 target.

- Morgan Stanley has an Overweight rating and lifted the price target from $270 to $285.

- Raymond James has a Strong Buy rating and $280 target.

- Needham has a Hold rating.

- Piper Sandler has a Neutral rating and $240 target.

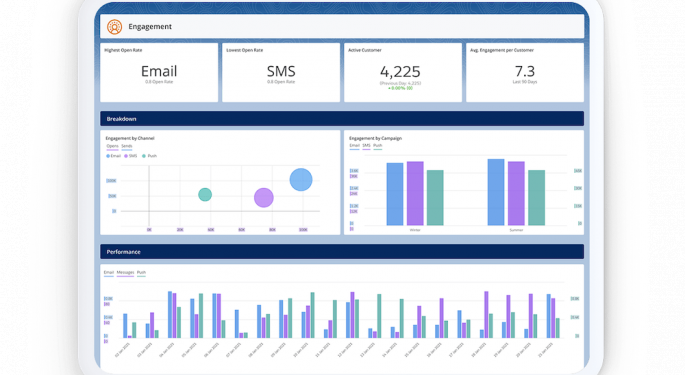

Photo courtesy of Salesforce.

Latest Ratings for CRM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wedbush | Maintains | Outperform | |

| Mar 2022 | Canaccord Genuity | Maintains | Buy | |

| Mar 2022 | Raymond James | Maintains | Strong Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Brent BracelinAnalyst Color Earnings News Guidance Price Target Reiteration Analyst Ratings Best of Benzinga