Boeing Shares Slump On 787 Delivery Halt

Boeing Co (NYSE: BA) shares are down 4.3% so far this week after the company reported disappointing first-quarter delivery numbers and announced its second 787 delivery halt in less than a year.

What Happened? On Tuesday, Boeing announced that undelivered 787s would need more work after the Federal Aviation Administration recently found large gaps around the forward pressure bulkhead of some of the planes.

Boeing also reported just 79 total jet deliveries in the second quarter of 2021, down by 35 deliveries from a year ago.

Related Link: Why Cowen Is Bullish On Boeing: '2022-24 Look Brighter'

Why It’s Important: On Wednesday, Bank of America analyst Ronald Epstein reiterated his Neutral rating and $265 price target for Boeing and said the company is still clearly facing some company-specific challenges as the global airline industry recovers from the pandemic.

Epstein was forecasting 114 Boeing deliveries in the second quarter, so the actual number fell well short of his expectations.

Epstein said the real risk is if the delays start turning into cancellations at some point.

“The delays in deliveries of over a year could start triggering penalties and no-fee walk-away optionality pretty soon. We estimate that, within the next twelve months, a third of current 787 orders in backlog will be affected by the 1yr+ delay clauses,” Epstein said.

He estimates Boeing currently has about 100 excess 878s in its inventory, more than a year’s worth of deliveries. In 2020, Boeing delivered about a third of the deliveries it had scheduled for early in the year.

Epstein has adjusted his forecasts following the latest delay and delivery numbers and is now targeting $4.5 billion in ash burn for Boeing in 2021, up from his previous cash burn estimate of $3.5 billion.

Benzinga’s Take: Boeing investors likely anticipated the stock would be a leading reopening play in 2021 given the rebound in the global airline industry. However, Boeing continues to struggle with quality issues, and the stock may continue to lag until investors are convinced that the company’s deliveries are back on track.

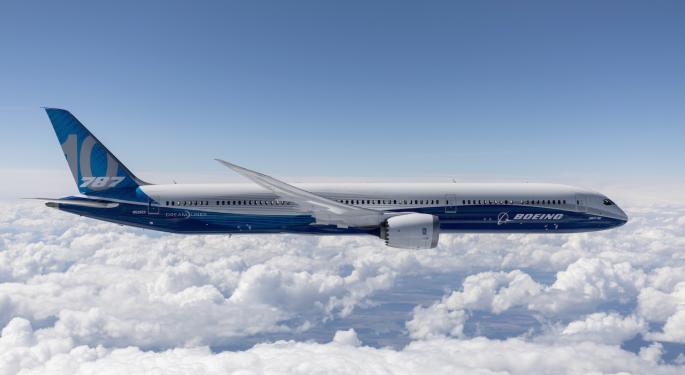

Photo: Boeing's 787-10 Dreamliner, courtesy of Boeing.

Latest Ratings for BA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Cowen & Co. | Maintains | Outperform | |

| Jan 2022 | Jefferies | Maintains | Buy | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: aircraftAnalyst Color News Price Target Travel Top Stories Analyst Ratings General Best of Benzinga