In A Peculiar Move, Volatility Rises Same Time As Stocks Rally On Monday: Here's What Happened

The major averages closed uniformly higher on Monday, reversing from the previous week’s losses. The buying spree may partly be attributed to profit-taking as some of the stocks got cheaper after a near-term uptrend that topped out in late November.

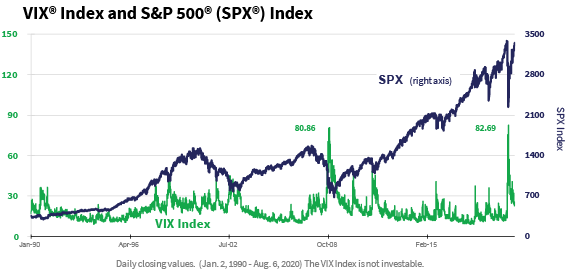

What Happened: In an unusual move, even as stocks rallied the CBOE Volatility Index, aka VIX, also advanced.

The SPDR S&P 500 ETF Trust (NYSE: SPY), an exchange-traded fund that tracks the performance of the broader S&P 500 Index, ended Monday’s session up 1.44%. Incidentally, the VIX advanced 9.5% during the session.

See Also: How To Invest In Startups

The VIX typically shares an inverse correlation with the S&P 500 Index and it is for this very reason the former is called the fear gauge.

Source: Bloomberg & CBOE

Analyzing The Anomaly: Commenting on the development, market strategist Charlie Bilello said it is rare to see volatility jump this much, with stocks closing higher.

The graphics shared by him showed 20 instances since 1990 when S&P 500 advanced along with spikes in VIX. Among these instances, only five times the gains of the S&P 500 Index were appreciable — Monday was one such day.

Unusual action in the markets today...

The $VIX closed UP 9.5% while the S&P 500 finished UP 1.4%.

Rare to see volatility jump this much with stocks closing higher. pic.twitter.com/FbUwh91XMp

— Charlie Bilello (@charliebilello) December 12, 2022

Traders could be pricing in higher volatility on Tuesday and Wednesday, when the November consumer price inflation report and the Fed decision, respectively are due, he added.

Price Action: The SPY closed Monday’s session 1.44% higher, at $398.95, according to Benzinga Pro data.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: CBOE Volatility Index Charlie BilelloAnalyst Color News Federal Reserve Markets Analyst Ratings Trading Ideas