Hedge Funds Get Squeezed As Bond Bulls Roar Back On Fed's Dovish Tone

Hedge funds have been on the wrong side of the Treasury market, at least lately. According to Bloomberg, they extended their short positions on Treasuries to a record high just before smaller-than-expected U.S. bond sales and disappointing job data ignited a bond market rally.

U.S. long-dated Treasury notes posted their most impressive week since early January 2023, in a bond rally triggered by a combination of factors, including the Federal Reserve’s decision to keep interest rates steady and a surprising slump in employment growth last month, which fueled speculation of potential rate cuts in 2023.

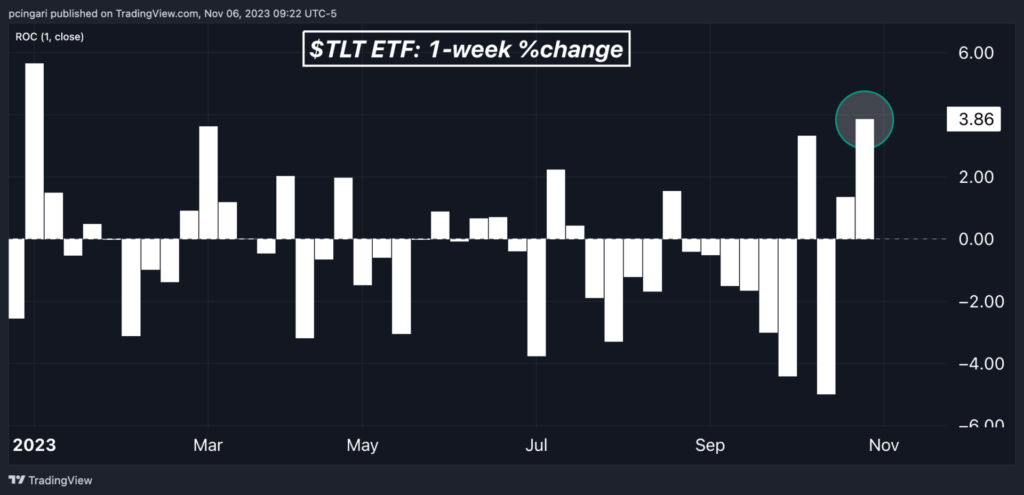

One of the notable beneficiaries of this trend has been the popular iShares 20+ Year Treasury Note ETF (NASDAQ:TLT), which recorded a substantial gain of 3.9% over the past week. This marks the ETF’s most robust performance since the beginning of the year when it surged by 5.6%.

Chart: Treasury Bonds Just Had Their Second-Best Week In 2023

Leveraged funds ramped up their net short positions in Treasury futures to levels unseen in data dating back to 2006, all while cash bonds experienced a rally in the preceding week, Bloomberg data showed.

Gareth Berry, a strategist at Macquarie Group Ltd. in Singapore, informed Bloomberg that leveraged funds had pushed their short positions on U.S. Treasuries to an extreme level last week, a development that may have signaled an impending market incident.

Bill Ackman’s Timely Exit

One significant turning point in this story was the decision by renowned hedge fund investor Bill Ackman, who, just two weeks ago, announced that he was covering his Treasury short positions.

These positions had delivered positive returns since August but were closed due to concerns over weakening economic data and global risks associated with the ongoing conflict in the Middle East.

Since Ackman’s tweet, 10-year Treasury yields have fallen from 5% to the current 4.6%, and the U.S. Treasury 10 Year Note ETF (NYSE:UTEN) has rallied by 3%.

Looking To 2024

Market-implied probabilities now suggest a greater likelihood of a rate cut, potentially as soon as May 2024.

Speculators are also pricing in nearly a full percentage point of rate cuts for the next year, according to CME Group Inc.’s Fedwatch tool.

CME FEDWATCH – MEETING PROBABILITIES AS OF NOV.6, 2023

MEETING DATE

3.50-3.75

3.75-4.00

4.00-4.25

4.25-4.50

4.50-4.75

4.75-5.00

5.00-5.25

5.25-5.50

5.50-5.75

5.75-6.00

No. of cumulative

rate

cuts

priced

12/13/2023

0,0%

0,0%

0,0%

0,0%

0,0%

0,0%

0,0%

90,2%

9,8%

0,0%

0

01/31/2024

0,0%

0,0%

0,0%

0,0%

0,0%

0,0%

0,0%

84,6%

14,8%

0,6%

0

03/20/2024

0,0%

0,0%

0,0%

0,0%

0,0%

0,0%

23,7%

65,1%

10,8%

0,4%

0

05/01/2024

0,0%

0,0%

0,0%

0,0%

0,0%

12,4%

45,3%

36,7%

5,4%

0,2%

1

06/12/2024

0,0%

0,0%

0,0%

0,0%

7,4%

32,0%

40,2%

18,0%

2,3%

0,1%

1

07/31/2024

0,0%

0,0%

0,0%

4,9%

23,7%

37,4%

25,5%

7,6%

0,8%

0,0%

2

09/18/2024

0,0%

0,0%

3,1%

16,9%

32,5%

29,8%

14,1%

3,3%

0,3%

0,0%

3

11/07/2024

0,0%

1,7%

10,4%

25,2%

31,1%

21,4%

8,3%

1,7%

0,2%

0,0%

3

12/18/2024

1,1%

7,3%

19,8%

28,9%

24,9%

13,1%

4,1%

0,7%

0,1%

0,0%

4

In a week marked by a scarcity of significant macroeconomic data releases, investors will be paying keen attention to forthcoming addresses by Federal Reserve officials.

Fed Chair Jerome Powell is set to deliver speeches on Wednesday at the Division of Research and Statistics Centennial Conference in Washington, D.C., and on Thursday at the 24th Jacques Polak Annual Research Conference, also in the nation’s capital.

Read More: US Labor Market Softening: October Nonfarm Payrolls Decline to 150,000, Below Wall Street Estimates

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Macro Economic Events Bonds Treasuries Top Stories Economics Federal Reserve Analyst Ratings