No Imminent AI Bubble Burst, Says Munster: 'We Are At The Start Of 3-5 Year Tech Run'

Big techs had a robust reporting season and their shares have climbed solidly in reaction to the stellar showing, and amid the irrational exuberance, a tech venture capitalist Wednesday allayed fears concerning a bubble in the works.

What Happened: U.S.-listed shares of chipmaker Arm Holdings plc (NASDAQ:ARM) last traded up 20% in after-hours trading on Wednesday after the company reported forecast-beating third-quarter results. The stock was up about 41% at one point in the after-hours session.

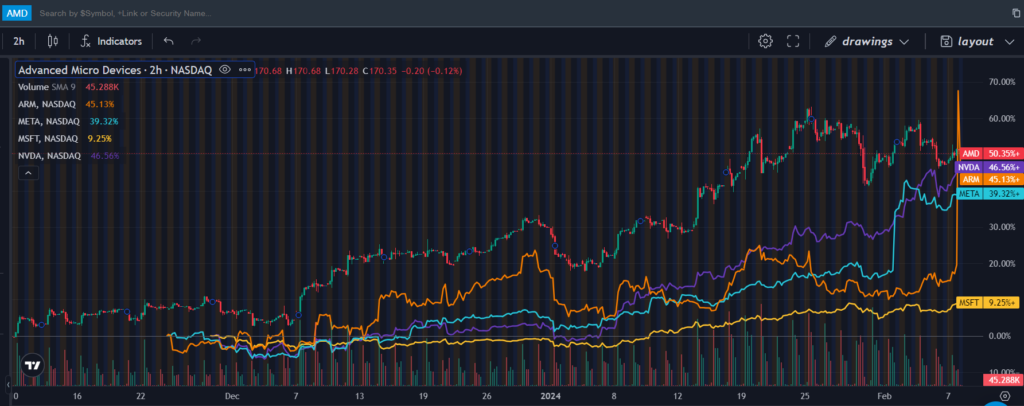

Deepwater Asset Management co-founder Gene Munster commented on the surge. “Six months ago there was talk we were at the peak of an AI bubble,” he said. The tech entrepreneur noted that most of the high-profile mega-cap tech stocks such as Microsoft Corp. (NASDAQ:MSFT), Meta Platforms, Inc. (NASDAQ:META), Advanced Micro Devices, Inc. (NASDAQ:AMD) and Nvidia Corp. (NASDAQ:NVDA) have rallied nicely since then.

Source: Benzinga Pro data

Munster do not see an imminent bubble burst. “I still believe we’re at the start of 3-5 year tech run that will end with an AI bubble,” Munster said.

See: Best Artificial Intelligence Stocks

Why It’s Important: Munster view mirrors the view of a majority of tech analysts who see the AI revolution just getting started. Trivariate Research CEO Adam Parker said in an interview with CNBC that the AI revolution is only in its very first innings.

“Like you’re the very early phases of something that hasn’t been deployed. So I I think you know when you think thematically you’re going to see software companies with accelerating revenue work you see semis with AI work and and I don’t think you want to bet against that this year,” he said.

Wedbush’s Daniel Ives repeated his bullish view on AI in a post this week. “AI Revolution and monetization is here and it's a ‘1995 Moment’ in our view,” he said, referring to the period when Internet gained popularity.

He said conference call transcripts of Microsoft and Palantir Technologies, Inc. (NYSE:PLTR) vouched to the fact.

The Invesco QQQ Trust (NASDAQ:QQQ) ended Wednesday’s session up 1.03% at $431.99, according to Benzinga Pro data.

Representational photo created using Dall-E 3

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Adam ParkerAnalyst Color Long Ideas News Top Stories Tech Media Trading Ideas