Amazon Prime Day 2024: Innovations Set To Overcome Economic Challenges, Ramp Up Sales

Amazon.com Inc (NASDAQ:AMZN) is gearing up for its 10th annual Prime Day on July 16-17, 2024. This year's event promises millions of deals across 35+ categories, drawing keen attention from analysts and consumers alike.

JPMorgan analyst Doug Anmuth shares an optimistic outlook, projecting low-teens year-over-year GMV and revenue growth despite broader economic pressures.

Amazon Prime Day Sales Projection At $12.4B GMV

Anmuth projects a total GMV of $12.4 billion for Prime Day, reflecting a 12% increase from last year. He expects total retail net sales to hit $7.9 billion, marking an 11% year-over-year growth. Notably, $5.8 billion of these net sales are deemed incremental, representing a 13% rise compared to sales without Prime Day. He emphasizes that these projections are factored into JPMorgan’s estimated Q3 retail net sales growth of 8% year-over-year.

According to Anmuth, Prime Day's financial impact extends beyond the two-day event. It promotes an early start to back-to-school shopping, helping Amazon manage inventory levels ahead of the busy second half of the year. He believes this strategic timing allows Amazon to gauge demand more effectively, streamline operations, and maintain record-fast delivery speeds.

GenAI To Bolster Consumer Interest

Prime Day 2024's enhancements include record delivery speeds, personalized recommendations, and innovative GenAI features. According to Anmuth, Amazon’s investment in faster delivery and personalized shopping experiences is likely to bolster consumer interest. The introduction of GenAI shopping assistant Rufus and expanded deal alerts are set to enhance the customer experience further.

Despite stabilized macro pressures, Anmuth acknowledges that consumers remain cautious about discretionary spending. However, he expects Amazon's innovative retail offerings and compelling deals to support robust demand. The analyst cites a recent Prime Day survey indicating 66% of consumers plan to make a purchase, with 75% aiming to maintain or increase their spending from last year.

Prime Day To Bolster Prime Member Acquisition – 325M Projected

Prime Day also serves as a catalyst for broader business benefits. Anmuth highlights that Prime Day drives Prime Member acquisition, with Amazon projected to reach nearly 325 million Prime Members by the end of 2024. Additionally, the event boosts advertiser demand, 3P seller participation, and awareness of Amazon’s other services like Prime Video and Music.

JPMorgan has kept Amazon on its Best Idea list and set a price target of $240 for December 2024. This target is based on about 28 times Amazon’s estimated 2025 free cash flow of $86 billion, and about 21 times the estimated 2026 free cash flow of $108 billion.

Anmuth concludes that Amazon's Prime Day innovations and strategic execution position it for continued success amid macroeconomic challenges.

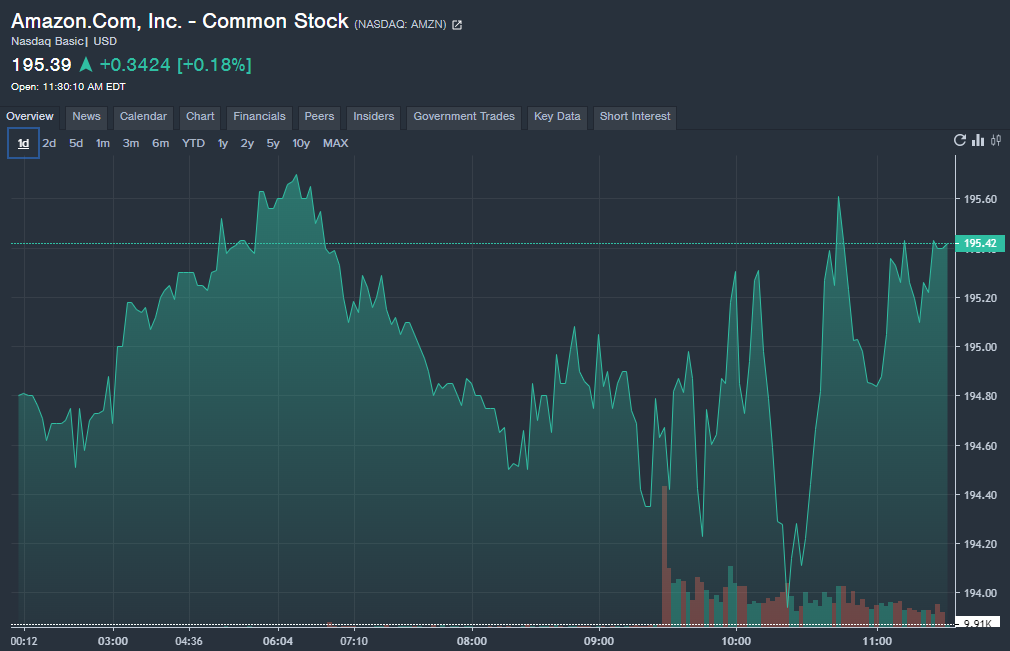

AMZN Price Check: Shares of Amazon were up 0.18% to $195.39 at the time of publication Friday, according to Benzinga Pro.

Read Next:

Photo: Shutterstock

Latest Ratings for AMZN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Buy | |

| Feb 2022 | Tigress Financial | Maintains | Buy | |

| Feb 2022 | Credit Suisse | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Amazon Prime DayAnalyst Color Long Ideas News Events Top Stories Analyst Ratings Trading Ideas