Microsoft's AI Lead Shrinks: Analyst Downgrades Stock As Amazon And Google Close The Gap

DA Davidson analyst Gil Luria downgraded the rating on Microsoft Corp (NASDAQ:MSFT) to Neutral from Buy while maintaining a price target of $475.

Luria noted competition has essentially caught up with Microsoft on the AI front, which reduces the justification for the current premium valuation.

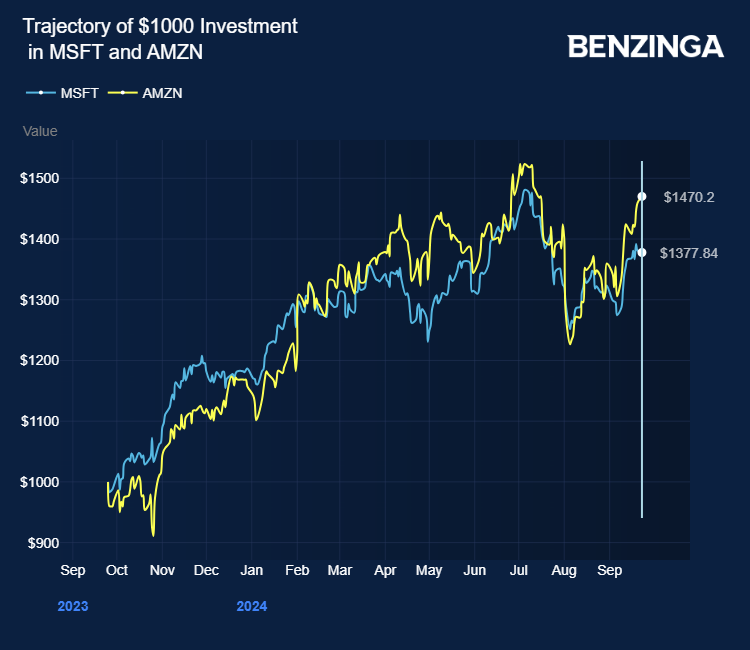

The analyst now ranked Microsoft fourth within the Magnificient Six. The stock increased 92% since his January 2023 initiation, compared to 49% for the S&P500.

Luria noted that Microsoft has accelerated growth and extended margins over the last few quarters as the first to embrace and commercialize generative AI. Through an early investment in OpenAI and the ability to quickly deploy capabilities within Azure and GitHub, it took a significant lead over Amazon.Com Inc (NASDAQ:AMZN) Amazon Web Service and Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Cloud, which translated to superior results over the prior 4-6 quarters.

The analyst noted that Microsoft’s lead is now diminished in both the cloud and code generation businesses, making it difficult for Microsoft to continue to outperform.

Luria said AWS is already adding nearly as much cloud business as Azure after a few quarters of Microsoft adding more business. Google Cloud Platform’s expansion has also seen its business accelerate to comparable growth rates as Azure prior quarter.

The analyst’s new proprietary hyperscaler semiconductor analysis indicates AWS and GCP are far ahead in deploying their silicon into their data centers, giving them a significant advantage over Azure in the future.

While Microsoft has discussed its Maia chips, it is years behind Amazon and Google and seems to be using them only to run Azure OpenAI Services workloads, he flagged. Luria noted this means Microsoft has been escalating an arms race it may not be able to prevail. He said this makes Microsoft beholden to Nvidia Corp (NASDAQ:NVDA), which means it will continue to shift wealth from its shareholders to Nvidia shareholders.

After significant margin expansion last year, Microsoft is now guiding for a decline in operating margins to pay for the data center capex, increasing from 12% to 21% of revenue, Luria emphasized. This is a higher rate of increase than Amazon and Google due to Microsoft’s greater reliance on Nvidia.

The analyst said that Microsoft overinvests at these rates yearly, diminishing margins by at least 100 bps cumulatively. To offset the margin drag, Microsoft would need to lay off ~10,000 employees for every year of over-investment.

While Nvidia and others have pointed to a strong ROI for hyperscalers such as Azure, Luria flagged that these returns may only last for a while.

The analyst noted Azure’s growth may be boosted by self-funded revenue, such as from OpenAI.

Luria noted Microsoft has also lost much of the lead for GitHub Copilot. Not only have Amazon and Gitlab mostly caught up to GitHub Copilot’s capabilities, he said Cursor has become the new standard.

Luria projected fiscal first-quarter 2025 revenue of $64.2 billion and EPS of $2.96.

Price Action: MSFT stock is down 0.50% at $433.10 at last check Monday.

Photo via Shutterstock

Latest Ratings for MSFT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Tigress Financial | Maintains | Buy | |

| Jan 2022 | Citigroup | Maintains | Buy | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Equities News Downgrades Price Target Analyst Ratings Tech Trading Ideas