Netflix To Become 'Default Choice' For TV, Movies? Analyst Predicts More Live Sports, Price Increases

Streaming giant Netflix Inc (NASDAQ:NFLX) could increase prices for ad-supported plans and the company’s standard plan to increase free cash flow, an analyst says ahead of the company’s third-quarter financial results.

The Netflix Analyst: JPMorgan analyst Doug Anmuth reiterated an Overweight rating on Netflix with a $750 price target in a new investor note.

Read Also: Netflix Analysts Turn More Optimistic Ahead Of Earnings: ‘Expensive For A Reason’

The Analyst Takeaways: Potential price increases and an update on the ad-supported plan are catalysts for Netflix that Anmuth is watching in the upcoming third-quarter financial results.

"We remain positive on Netflix shares heading into third-quarter earnings on Thursday, Oct. 17, while recognizing elevated expectations," Anmuth said.

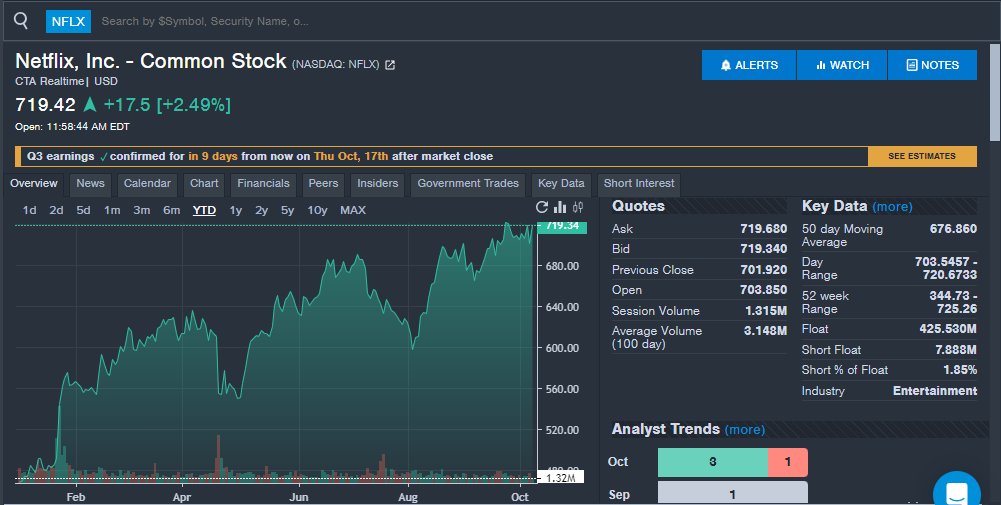

The analyst highlights Netflix stock is up 17% from August lows and up more than 40% year-to-date, as seen on the Benzinga Pro chart below.

Despite Netflix stock trading near all-time highs, Anmuth is bullish on several upcoming catalysts for the streaming company.

"We remain bullish on NFLX's ability to grow revenue in the mid-teens in 2024 & 2025 and low double-digits in 2026, further expand margins and drive multi-year FCF growth."

The analyst said Netflix's ad-supported plan can continue to increase monetization efforts for the company in 2025 and beyond.

"While the Ad Tier is currently a drag on total company ARM (average revenue per member), we expect focus on ad formats, NFLX's in-house ad tech platform, and programmatic and measurement partnerships to drive higher monetization."

Netflix's basic plan ($11.99 per month) could make up around 15% of U.S. subscribers said Anmuth. With the plan being phased out, some users will have to shift to the ad-supported plan or up to the $15.49 per month standard plan.

The streaming giant could also raise the price of the standard plan or the ad-supported plan soon, according to Anmuth. The analyst notes the standard plan was last increased in January 2022.

Anmuth predicts Netflix had net adds of seven million in the third quarter, compared to most investors predicting six to seven million.

While engagement was high among users in the third quarter with shows and movies, Anmuth is already looking ahead.

"We believe the fourth-quarter content slate is strong."

The analyst highlights shows like "Outer Banks," "Lonely Planet" and "Squid Game," while also mentioning the live sports content that includes a boxing match between Jake Paul and Mike Tyson and two National Football League games on Christmas Day.

"We expect a bigger push into live sports over time, particularly as negotiating leverage shifts in NFLX's direction."

Anmuth said Netflix's ad-supported plan growth and a price increase will lead to higher free cash flow guidance by the company.

"We believe NFLX's global scale, strong engagement and diversified content will push NFLX toward becoming the default choice for how users consume TV, film & other long-form content."

NFLX Price Action: Netflix stock is up 2.45% to $718.97 on Tuesday versus a 52-week trading range of $344.73 to $725.25.

Read Next:

Photo: Shutterstock

Latest Ratings for NFLX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wedbush | Upgrades | Underperform | Neutral |

| Jan 2022 | Citigroup | Upgrades | Neutral | Buy |

| Jan 2022 | Rosenblatt | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Entertainment Price Target Reiteration Sports Analyst Ratings Media Trading Ideas