GameStop Cash Pile Expands 3.4% In Q4 Amid Bitcoin Buying Report: Analyst Says Stock Could Drop If Valued As A BTC Treasury Like Michael Saylor's MSTR

GameStop Corp. (NYSE:GME) reported a 3.44% increase in its cash holdings during the fourth quarter. It reported a mixed quarter and announced that its board has unanimously agreed to add Bitcoin (CRYPTO: BTC) as a treasury reserve asset.

What Happened: GameStop reported cash, cash equivalents, and marketable securities worth $4.775 billion at the close of the fourth quarter, which represented a 3.44% increase from $4.616 billion in the third quarter.

The company also announced adding Bitcoin as a reserve asset to its portfolio, confirming the February speculation when the stock had surged after the video game retailer’s chairman and CEO, Ryan Cohen, posed with Michael Saylor.

However, Wedbush Securities’ managing director of equity research, Michael Pachter, told Yahoo Finance that if GME is valued like a BTC treasury company akin to Saylor’s Strategy Inc. (NASDAQ:MSTR), the company’s stock would have to decline.

He described GME as “a rich man’s MicroStrategy,” adding that “if you want to pay even more for even less, you can buy GameStop.” Furthermore, Pachter explained that the company was unlikely to make any profit “ever”.

Pachter highlighted that the company’s strategy has changed about six times in three years. Comparing it to MSTR, he added that the latter trades at about two times its Bitcoin holdings.

"If GameStop were to buy all Bitcoin with their $4.6 billion in cash (third quarter figure) and trade at two times (their bitcoin holdings), the stock would drop five bucks," he said.

Pachter had an underperform rating on GME with a price target of $10 apiece.

Why It Matters: MSTR has a market capitalization of $89.03 billion, and as of March 23, it had invested $33.7 billion to purchase 506,137 Bitcoins, averaging at $66,608 per coin. GME, on the other hand, had a market capitalization of $11.35 billion.

GameStop’s fourth-quarter revenue fell short of expectations at $1.283 billion, down 28% year-over-year, despite adjusted earnings per share of 30 cents, which significantly exceeded analyst estimates of 8 cents.

Revenue breakdowns included $725.8 million for hardware and accessories, $286.2 million for software, and $270.6 million for collectibles. However, net income surged to $131.3 million, a substantial increase from $63.1 million in the same period last year.

Price Action: GameStop fell 0.82% on Tuesday, and it was up 13.62% in premarket on Wednesday. The stock has fallen 18.95% on a year-to-date basis, whereas it is 67.99% higher over a year.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were mixed in premarket on Wednesday. The SPY was up 0.006% to $575.50, while the QQQ declined 0.043% to $493.25, according to Benzinga Pro data.

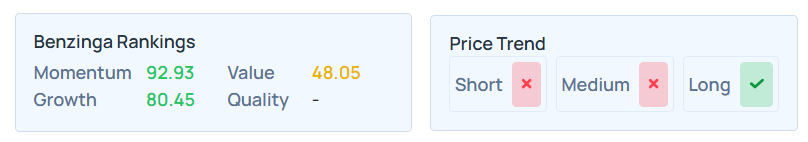

Benzinga’s Edge Rankings suggest that GME is experiencing a negative price trend for both short and medium-term periods. While its momentum was ranked at the 92.93th percentile, growth and value rankings were notably weak, detailed information is available here.

Read Next:

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: BitcoinAnalyst Color Cryptocurrency Equities News Markets Analyst Ratings General