Wall Street's Most Accurate Analysts Weigh In On 3 Energy Stocks With Over 4% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

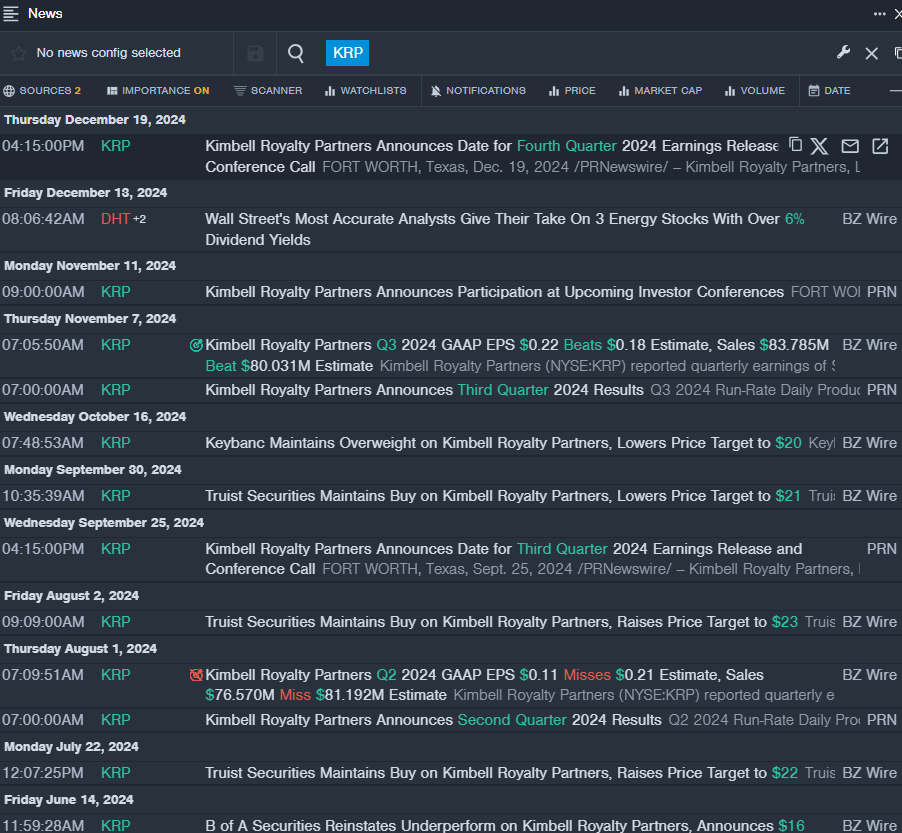

Kimbell Royalty Partners, LP (NYSE:KRP)

- Dividend Yield: 10.21%

- Truist Securities analyst Neal Dingmann maintained a Buy rating and cut the price target from $23 to $21 on Sept. 30. This analyst has an accuracy rate of 66%.

- Raymond James analyst John Freeman maintained a Strong Buy rating and cut the price target from $22 to $20 on Jan. 24. This analyst has an accuracy rate of 78%.

- Recent News: Kimbell Royalty Partners will release its fourth quarter financial results on Thursday, Feb. 27, 2025, before the opening bell.

- Benzinga Pro's real-time newsfeed alerted to latest KRP news.

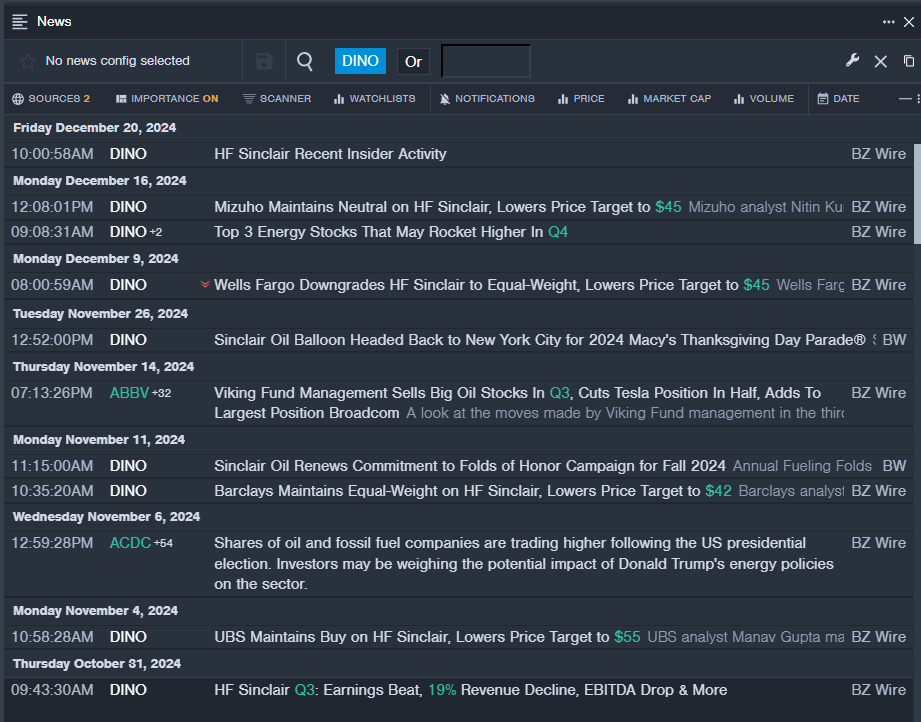

HF Sinclair Corporation (NYSE:DINO)

- Dividend Yield: 5.84%

- Wells Fargo analyst Roger Read downgraded the stock from Overweight to Equal-Weight and cut the price target from $53 to $45 on Dec. 9. This analyst has an accuracy rate of 63%.

- Barclays analyst Theresa Chen maintained an Equal-Weight rating and cut the price target from $44 to $42 on Nov. 11. This analyst has an accuracy rate of 76%.

- Recent News: On Oct. 31, HF Sinclair reported a third-quarter revenue decline of 19% year over year to $7.207 billion, beating the consensus of $6.833 billion.

- Benzinga Pro's real-time newsfeed alerted to latest DINO news

APA Corporation (NASDAQ:APA)

- Dividend Yield: 4.46%

- Wells Fargo analyst Roger Read downgraded the stock from Overweight to Equal-Weight and slashed the price target from $42 to $25 on Dec. 17. This analyst has an accuracy rate of 63%.

- Citigroup analyst Scott Gruber maintained a Neutral rating and lowered the price target from $29 to $24 on Nov. 26. This analyst has an accuracy rate of 62%.

- Recent News: On Dec. 23, APA announced the pricing terms of cash tender offers for certain series of outstanding Apache Corporation notes.

- Benzinga Pro’s charting tool helped identify the trend in APA stock.

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas