Wall Street's Most Accurate Analysts Give Their Take On 3 Risk Off Stocks With Over 3% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

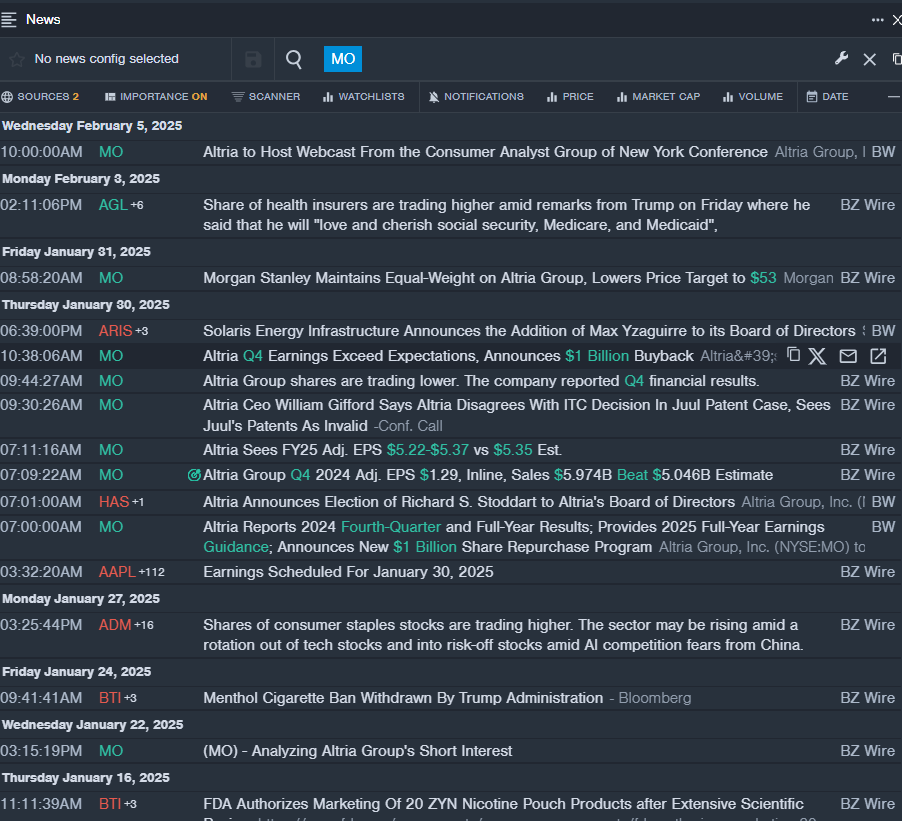

Altria Group, Inc. (NYSE:MO)

- Dividend Yield: 7.65%

- B of A Securities analyst Lisa Lewandowski upgraded the stock from Neutral to Buy and increased the price target from $55 to $65 on Dec. 6, 2024. This analyst has an accuracy rate of 62%.

- Barclays analyst Gaurav Jain maintained an Underweight rating and raised the price target from $45 to $46 on Nov. 6, 2024. This analyst has an accuracy rate of 69%.

- Recent News: On Jan. 30, Altria Group posted quarterly sales of $5.974 billion beating the analyst consensus estimate of $5.046 billion.

- Benzinga Pro’s real-time newsfeed alerted to latest MO news.

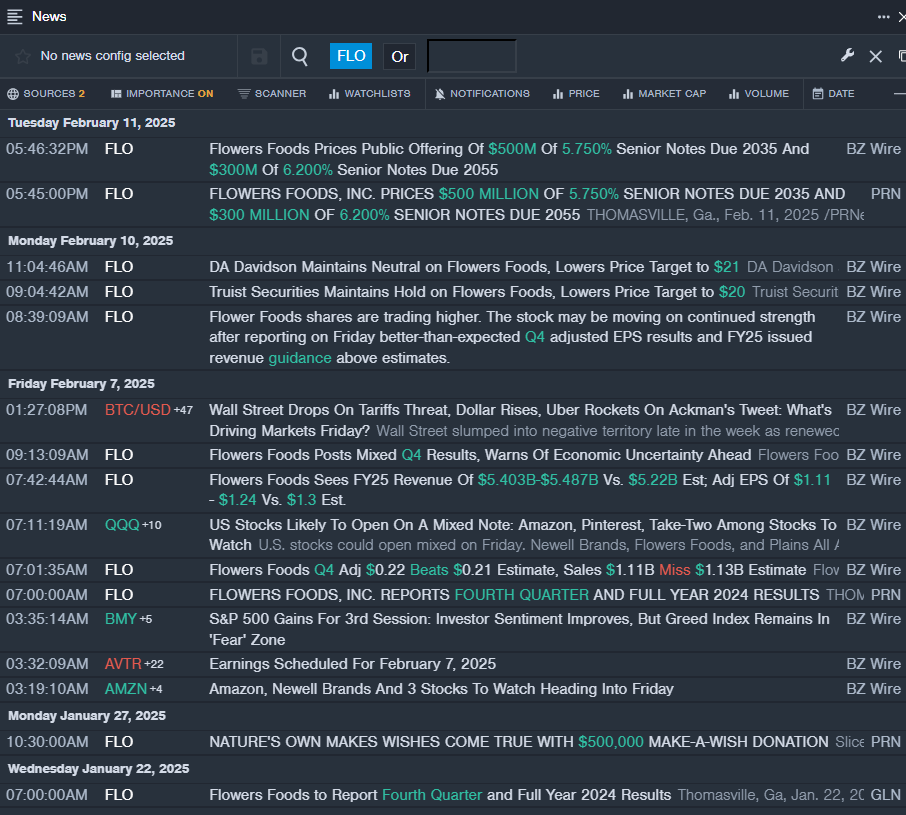

Flowers Foods, Inc. (NYSE:FLO)

- Dividend Yield: 5.21%

- DA Davidson analyst Brian Holland maintained a Neutral rating and cut the price target from $24 to $21 on Feb. 10, 2025. This analyst has an accuracy rate of 63%.

- Deutsche Bank analyst Steve Powers maintained a Hold rating and increased the price target from $22 to $23 on May 9, 2024. This analyst has an accuracy rate of 66%.

- Recent News: On Feb. 11, Flowers Foods priced its public offering of $500 million of 5.750% senior notes due 2035 and $300 million of 6.200% senior notes due 2055.

- Benzinga Pro's real-time newsfeed alerted to latest FLO news.

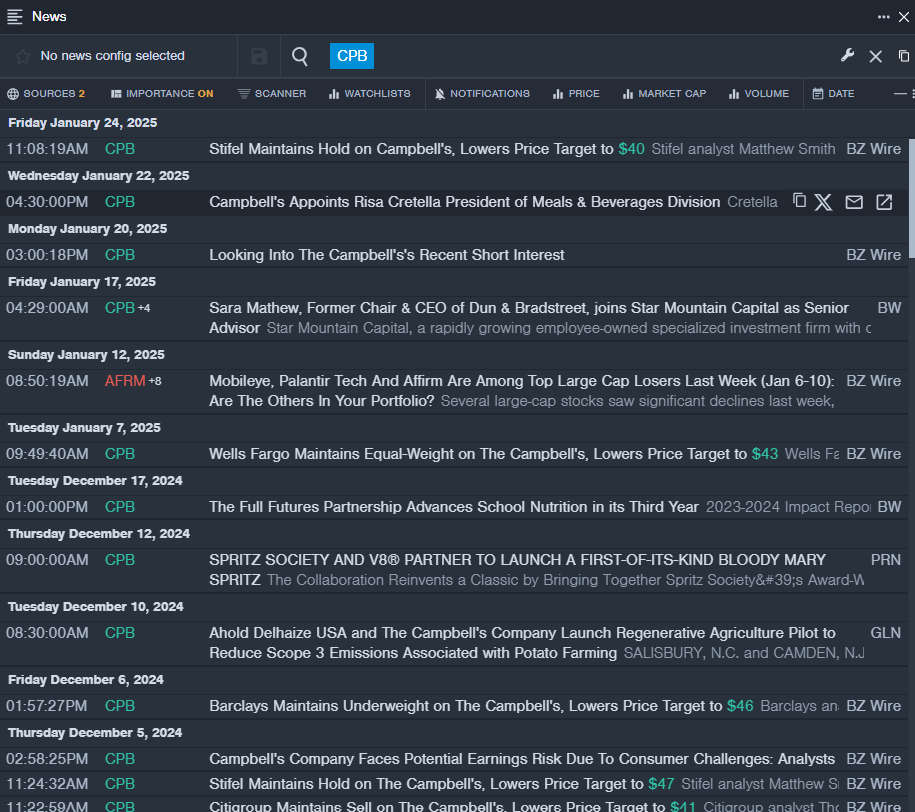

The Campbell’s Company (NASDAQ:CPB)

- Dividend Yield: 3.89%

- Wells Fargo analyst Chris Carey maintained an Equal-Weight rating and cut the price target from $45 to $43 on Jan. 7, 2025. This analyst has an accuracy rate of 60%.

- DA Davidson analyst Brian Holland maintained a Neutral rating with a price target of $51 on Dec. 4, 2024. This analyst has an accuracy rate of 63%.

- Recent News: On Jan. 22, Campbell’s named Risa Cretella President of Meals & Beverages Division.

- Benzinga Pro’s real-time newsfeed alerted to latest CPB news.

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas