Wall Street's Most Accurate Analysts Give Their Take On 3 Real Estate Stocks With Over 9% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

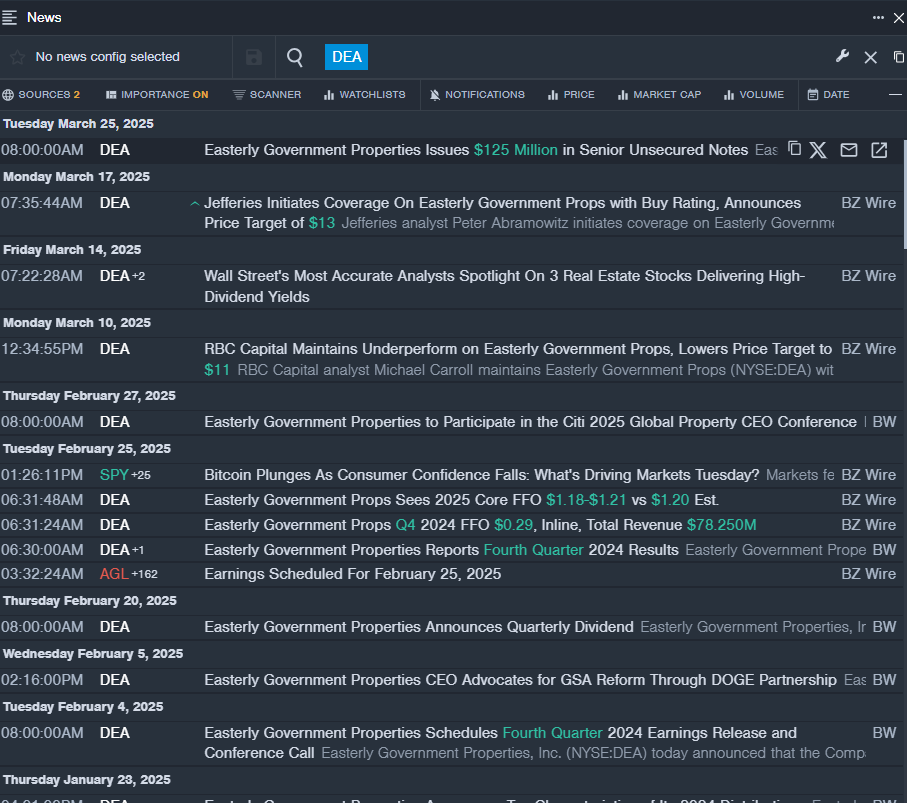

Easterly Government Properties, Inc. (NYSE:DEA)

- Dividend Yield: 11.52%

- RBC Capital analyst Michael Carroll maintained an Underperform rating and cut the price target from $12 to $11 on March 10, 2025. This analyst has an accuracy rate of 64%.

- Truist Securities analyst Michael Lewis maintained a Hold rating and slashed the price target from $14 to $13 on Dec. 6, 2024. This analyst has an accuracy rate of 69%.

- Recent News: On March 25, Easterly Government Properties issued $125 million in senior unsecured notes.

- Benzinga Pro’s real-time newsfeed alerted to latest DEA news.

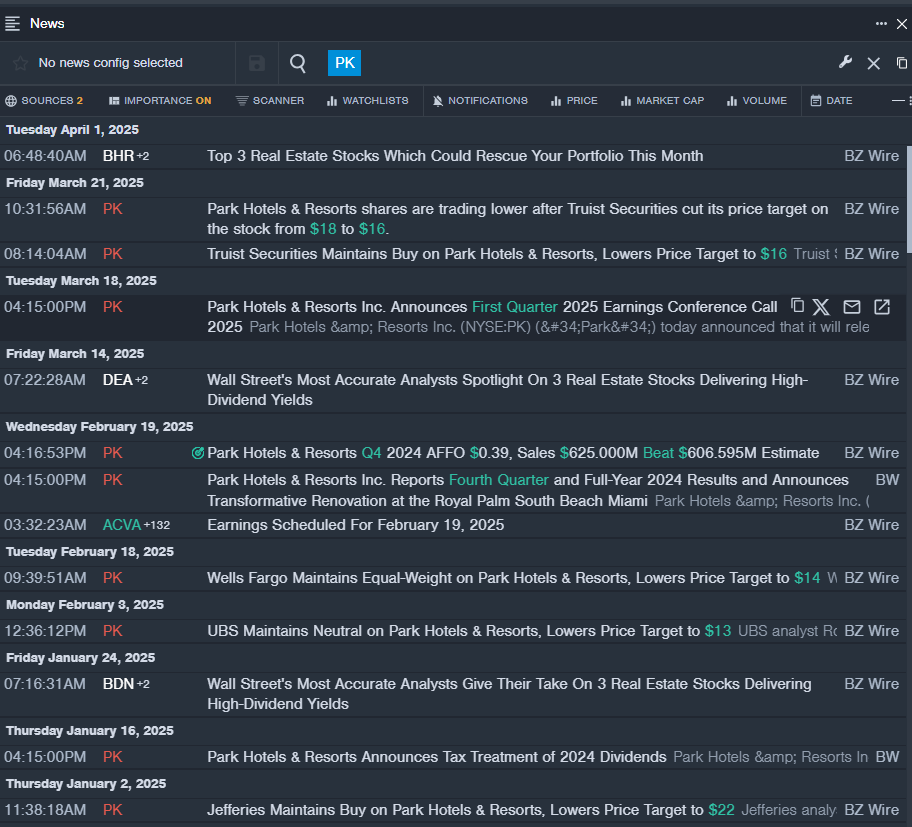

Park Hotels & Resorts Inc. (NYSE:PK)

- Dividend Yield: 11.30%

- Truist Securities analyst Patrick Scholes maintained a Buy rating and slashed the price target from $18 to $16 on March 21, 2025. This analyst has an accuracy rate of 62%.

- UBS analyst Robin Farley maintained a Neutral rating and cut the price target from $15 to $13 on Feb. 3, 2025. This analyst has an accuracy rate of 77%.

- Recent News: Park Hotels & Resorts will release its financial results for the first quarter before the stock market opens on Monday, May 5.

- Benzinga Pro's real-time newsfeed alerted to latest PK news

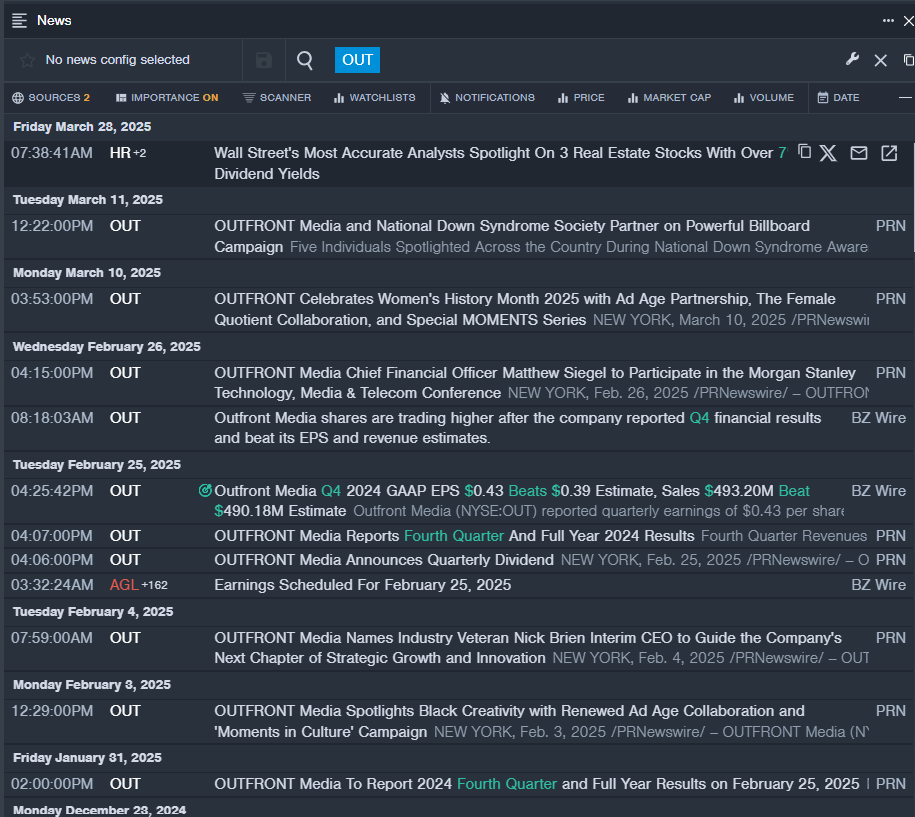

OUTFRONT Media Inc. (NYSE:OUT)

- Dividend Yield: 9.05%

- Morgan Stanley analyst Benjamin Swinburne maintained an Equal-Weight rating and raised the price target from $17.51 to $18.54 on Dec. 18, 2024. This analyst has an accuracy rate of 76%.

- TD Cowen analyst Lance Vitanza initiated coverage on the stock with a Hold rating and a price target of $16.48 on July 16, 2024. This analyst has an accuracy rate of 73%.

- Recent News: On Feb. 25, Outfront Media reported fourth-quarter financial results and beat its EPS and revenue estimates.

- Benzinga Pro’s real-time newsfeed alerted to latest OUT news

Read More:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas