Snowflake Jumps 8% Pre-Market After Piper Sander Hikes Price Target To $215, Calls It 'High-Conviction Growth Play'

Snowflake Inc. (NYSE:SNOW) shares are on the rise after a strong first-quarter earnings performance, followed by a hike in its price target by Piper Sandler.

What Happened: The stock is up 7% in pre-market trading on Thursday, after Piper Sandler analysts, led by Brent Bracelin, reaffirmed their “overweight” rating on the stock, while increasing the price target to $215, from $175, representing a 20% upside from current levels.

Bracelin called Snowflake one of their “highest conviction growth ideas” for 2025, with the bullish thesis resting on it achieving “Rule of 50,” which means 25% product revenue growth, alongside 25% in free cash flow margins, at over $4 billion in annual recurring revenue.

“Solid Q1 execution evident by the $39 million beat on 26% y/y product growth was encouraging given an uncertain macro backdrop,” the note says.

It also highlights two $100 million-plus deals with financial services customers and a sharp uptick in customers using AI/ML tools weekly, which now stands at over 5,200, up from 4,000 the prior quarter.

The analysts note that while most other software companies they cover have maintained their annual guidance “out of an abundance of caution,” Snowflake has raised its annual product revenue guidance by $45 million at the midpoint, or 25% year-over-year growth, ahead of 24% that was guided earlier.

Why It Matters: Most other leading analysts remain upbeat on the stock, with an average consensus Price Target of $203.69, an upside of 13.7% from current levels.

The stock is up 27.73% over the past 1 month, since its late-April lows, and is up 13.72% year-to-date, following a volatile couple of weeks recently.

The company released its first quarter results on Wednesday, reporting $1.04 billion in revenue, beating consensus estimates of $1.01 billion. It reported a profit of $0.24 per share, ahead of estimates at $0.21 per share.

Price Action: The stock was down 2.06% on Wednesday, trading at $179.12 per share, but is up 8.50% after hours, following its first quarter results and an increase in analyst price targets.

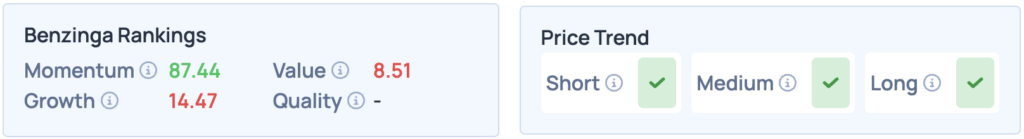

According to Benzinga’s Edge Stock Rankings, the stock scores well on Momentum, but fares poorly on Growth and Value. It has a favorable price trend in the short, medium, and long term. Click here for deeper insights.

Read More:

Photo courtesy: Tada Images / Shutterstock.com

Latest Ratings for SNOW

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Cowen & Co. | Maintains | Outperform | |

| Mar 2022 | Rosenblatt | Maintains | Neutral | |

| Mar 2022 | Jefferies | Maintains | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Brent Bracelin Piper SandlerEquities News Price Target Markets Analyst Ratings