Sprinklr Analysts Boost Their Forecasts After Upbeat Earnings

Sprinklr, Inc (NYSE:CXM) reported better-than-expected fiscal first-quarter 2026 results on Wednesday.

The quarterly sales of $205.5 million beat the analyst consensus estimate of $203.3 million, and adjusted EPS of 12 cent beat the analyst consensus estimate of $0.10.

Subscription revenue increased 3.8% Y/Y to $184.13 million.

Sprinklr expects fiscal 2026 revenue of $825.00 million-$827.00 million (prior 821.50 million-$823.50 million) vs. the consensus estimate of $821.94 million. The company projects subscription revenue of $741 million-$743 million. The company raised its adjusted EPS to $0.39-$0.40 (prior $0.38-$0.39) versus the $0.38 consensus estimate.

For the second quarter, the company sees revenue of $205.00 million-$206.00 million vs. analyst estimate $207.16 million and adjusted EPS of $0.10 (vs. street view of $0.10). The company projects subscription revenue of $184 million-$185 million.

Sprinklr shares fell 2.4% to close at $8.86 on Thursday.

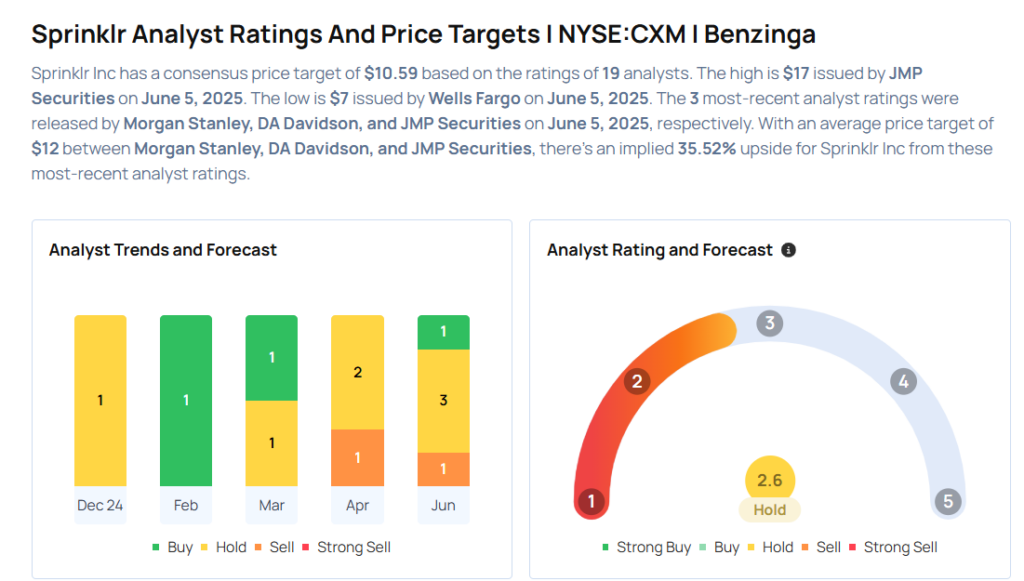

These analysts made changes to their price targets on Sprinklr following earnings announcement.

- Wells Fargo analyst Michael Berg maintained Sprinklr with an Underweight rating and raised the price target from $6 to $7.

- DA Davidson analyst Clark Wright maintained the stock with a Neutral and raised the price target from $8 to $9.

- Morgan Stanley analyst Elizabeth Porter maintained Sprinklr with an Equal-Weight rating and raised the price target from $8 to $10.

Considering buying CXM stock? Here’s what analysts think:

Photo via Shutterstock

Latest Ratings for CXM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Keybanc | Downgrades | Overweight | Sector Weight |

| Jan 2022 | Wells Fargo | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas