Braze Analysts Slash Their Forecasts After Q1 Earnings

Braze, Inc. (NASDAQ:BRZE) reported better-than-expected earnings for the first quarter on Thursday.

The company posted quarterly earnings of 7 cents per share which beat the analyst consensus estimate of 5 cents per share. The company reported quarterly sales of $162.06 million which beat the analyst consensus estimate of $158.66 million.

Braze lowered its FY2026 adjusted EPS guidance from 31 cents to 35 cents, but raised its FY2026 sales outlook from $686.00 million-$691.00 million to $702.00 million-$706.00 million.

“We are off to a good start in fiscal year 2026, delivering strong revenue growth, profitability, and free cash flow in an ever-changing environment,” said Bill Magnuson, Cofounder and CEO of Braze. “I’m also excited to announce that Ed McDonnell will be joining Braze in July to lead all aspects of our global revenue operations. McDonnell has a strong track record of delivering results at high-growth public SaaS businesses, and we believe his extensive background in Software and Customer Engagement will further solidify Braze as the leading customer engagement platform and accelerate growth in the coming years.”

Braze shares dipped 12.6% to trade at $31.50 on Friday.

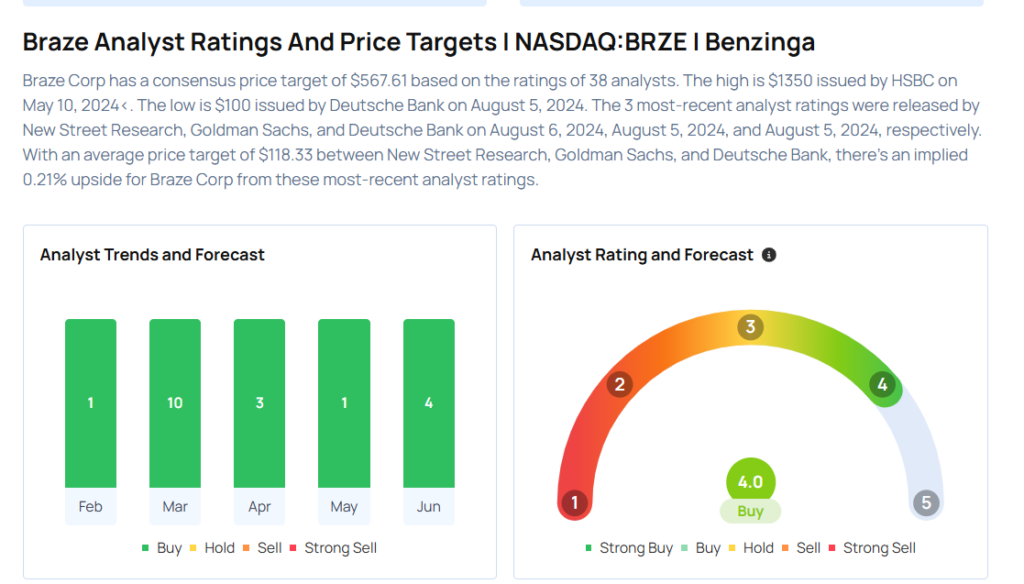

These analysts made changes to their price targets on Braze following earnings announcement.

- Stephens & Co. analyst Brett Huff maintained Braze with an Overweight rating and lowered the price target from $51 to $41.

- UBS analyst Taylor McGinnis maintained Braze with a Buy rating and cut the price target from $51 to $48.

- JMP Securities analyst Patrick Walravens reiterated Braze with a Market Outperform and maintained a $68 price target.

Considering buying BRZE stock? Here’s what analysts think:

Read This Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Trading Ideas