AAR Likely To Report Higher Q4 Earnings; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

AAR Corp. (NYSE:AIR) will release earnings results for the fourth quarter, after the closing bell on Wednesday, July 16.

Analysts expect the Wood Dale, Illinois-based company to report quarterly earnings at $1.01 per share, up from 88 cents per share in the year-ago period. AAR projects to report quarterly revenue at $695.81 million, compared to $656.5 million a year earlier, according to data from Benzinga Pro.

On April 7, AAR named Sharon Purnell Senior Vice President and Chief Human Resources Officer.

AAR shares fell 0.2% to close at $74.72 on Monday.

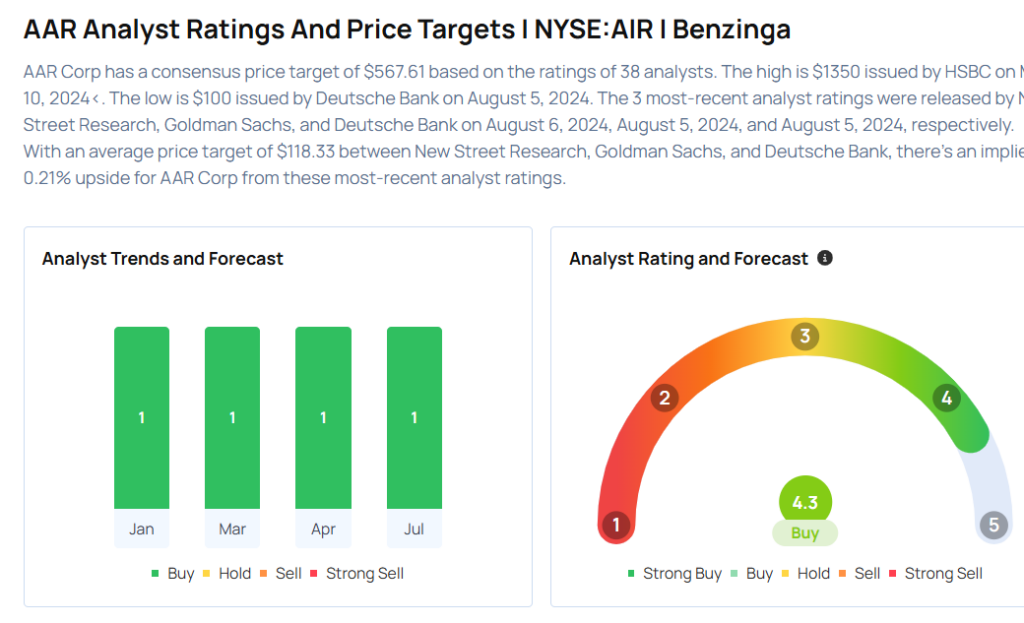

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Truist Securities analyst Michael Ciarmoli maintained a Buy rating and raised the price target from $78 to $81 on July 11, 2025. This analyst has an accuracy rate of 83%.

- Keybanc analyst Michael Leshock maintained an Overweight rating and cut the price target from $83 to $80 on April 2, 2025. This analyst has an accuracy rate of 84%.

- RBC Capital analyst Ken Herbert reiterated an Outperform rating with a price target of $75 on Nov. 4, 2024. This analyst has an accuracy rate of 75%.

- Benchmark analyst Josh Sullivan reiterated a Buy rating with a price target of $83 on Sept. 24, 2025. This analyst has an accuracy rate of 88%.

- Stifel analyst Bert Subin maintained a Buy rating and cut the price target from $86 to $85 on July 19, 2024. This analyst has an accuracy rate of 63%.

Considering buying AIR stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for AIR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Oct 2021 | RBC Capital | Initiates Coverage On | Outperform | |

| Jul 2021 | Credit Suisse | Maintains | Outperform | |

| Mar 2021 | Credit Suisse | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings News Price Target Markets Analyst Ratings Trading Ideas