Synovus Financial Gears Up For Q2 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Synovus Financial Corp. (NYSE:SNV) will release earnings results for the second quarter, after the closing bell on Wednesday, July 16.

Analysts expect the Columbus, Georgia-based company to report quarterly earnings at $1.25 per share, up from $1.16 per share in the year-ago period. Synovus Financial projects to report quarterly revenue of $585.99 million, compared to $306.15 million a year earlier, according to data from Benzinga Pro.

On April 16, Synovus posted better-than-expected earnings for the first quarter.

Synovus Financial shares dipped 4% to close at $52.53 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

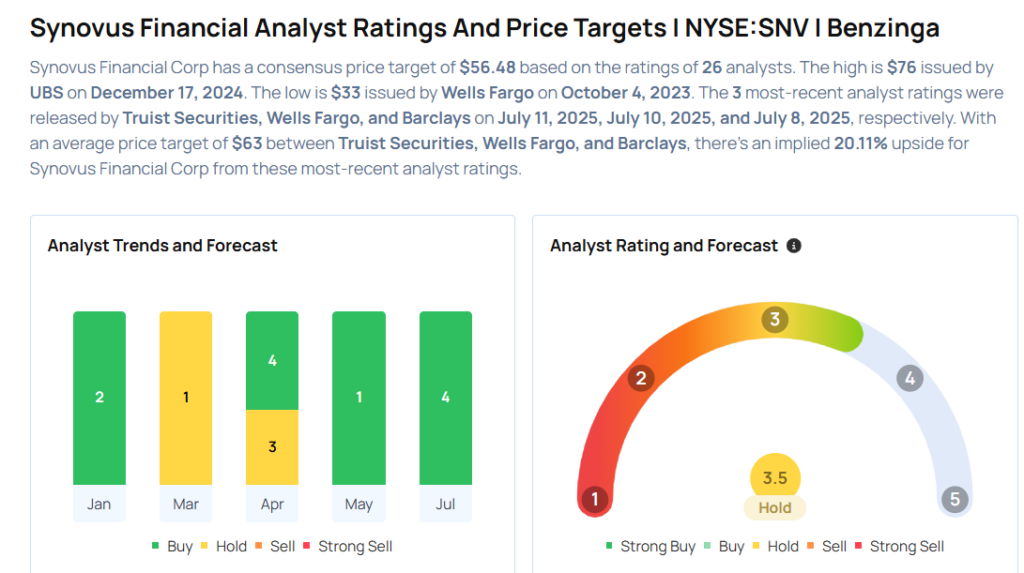

- Truist Securities analyst David Smith maintained a Buy rating and raised the price target from $56 to $60 on July 11, 2025. This analyst has an accuracy rate of 73%.

- Wells Fargo analyst Timur Braziler upgraded the stock from Equal-Weight to Overweight and raised the price target from $50 to $62 on July 10, 2025. This analyst has an accuracy rate of 62%.

- Barclays analyst Jared Shaw maintained an Overweight rating and boosted the price target from $60 to $67 on July 8, 2025. This analyst has an accuracy rate of 68%.

- DA Davidson analyst Gary Tenner maintained a Buy rating and cut the price target from $65 to $60 on April 21, 2025. This analyst has an accuracy rate of 77%.

- Raymond James analyst Michael Rose downgraded the stock from Outperform to Market Perform on April 2, 2025. This analyst has an accuracy rate of 69%

Considering buying SNV stock? Here’s what analysts think:

Read This Next:

Latest Ratings for SNV

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Raymond James | Maintains | Outperform | |

| Dec 2021 | JP Morgan | Upgrades | Neutral | Overweight |

| Dec 2021 | Morgan Stanley | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Wall Street's Most Accurate AnalystsEarnings News Price Target Markets Analyst Ratings Trading Ideas