Top Wall Street Forecasters Revamp GE Aerospace Expectations Ahead Of Q2 Earnings

GE Aerospace (NYSE:GE) will release earnings results for the second quarter, before the opening bell on Thursday, July 17.

Analysts expect the Evendale, Ohio-based company to report quarterly earnings at $1.40 per share, up from $1.20 per share in the year-ago period. GE Aerospace projects to report quarterly revenue of $9.51 billion, compared to $8.22 billion a year earlier, according to data from Benzinga Pro.

On July 7, GE Aerospace announced a multi-year service, repair, and overhaul (MRO) agreement with China Airlines covering GE9X engines for its 14 Boeing 777X aircraft.

GE Aerospace shares gained 0.9% to close at $264.67 on Tuesday.

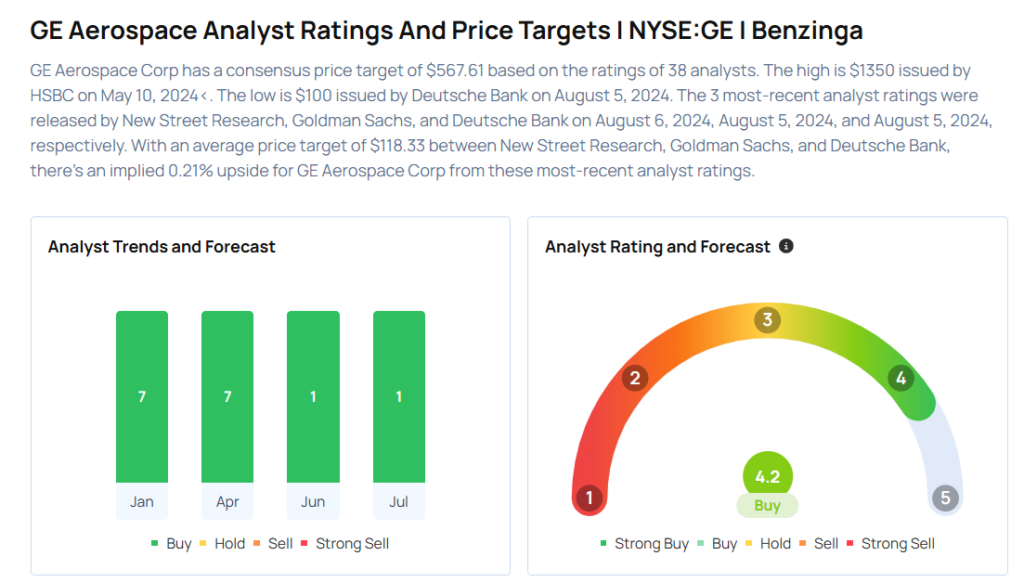

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- RBC Capital analyst Ken Herbert maintained an Outperform rating and raised the price target from $220 to $275 on June 3, 2025. This analyst has an accuracy rate of 76%.

- B of A Securities analyst Ronald Epstein maintained a Buy rating and raised the price target from $225 to $230 on April 25, 2025. This analyst has an accuracy rate of 67%.

- Wells Fargo analyst Matthew Akers maintained an Overweight rating and boosted the price target from $212 to $222 on April 24, 2025. This analyst has an accuracy rate of 75%.

- UBS analyst Gavin Parsons maintained a Buy rating and raised the price target from $207 to $216 on April 23, 2025. This analyst has an accuracy rate of 66%.

- JP Morgan analyst Seth Seifman maintained an Overweight rating and raised the price target from $190 to $210 on Jan. 24, 2025. This analyst has an accuracy rate of 83%

Considering buying GE stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for GE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | RBC Capital | Maintains | Outperform | |

| Mar 2022 | Credit Suisse | Maintains | Outperform | |

| Feb 2022 | Morgan Stanley | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Top Wall Street ForecastersEarnings News Price Target Markets Analyst Ratings Trading Ideas