U.S. Bancorp Analysts Raise Their Forecasts After Q2 Earnings

U.S. Bancorp (NYSE:USB) posted upbeat earnings for the second quarter but fell short of revenue expectations.

The company reported second-quarter adjusted earnings per share of $1.11, beating the analyst consensus estimate of $1.07.

Quarterly sales of $7.004 billion (+2% year over year) missed the Street view of $7.052 billion. On a GAAP basis, U.S. Bancorp registered revenues of $6.975 billion, missing the analyst consensus estimate of $7.052 billion.

"Year-over-year top-line revenue growth, coupled with our continued expense discipline, resulted in 250 basis points of positive operating leverage, as adjusted, and an efficiency ratio of 59.2% for the quarter," said the company's CEO Gunjan Kedia.

U.S. Bancorp anticipates its full-year 2025 taxable-equivalent revenue will increase by 3%–5% compared to 2024. For the third quarter, the company expects net interest income to be between $4.1 billion and $4.2 billion.

U.S. Bancorp shares fell 1% to close at $45.21 on Thursday.

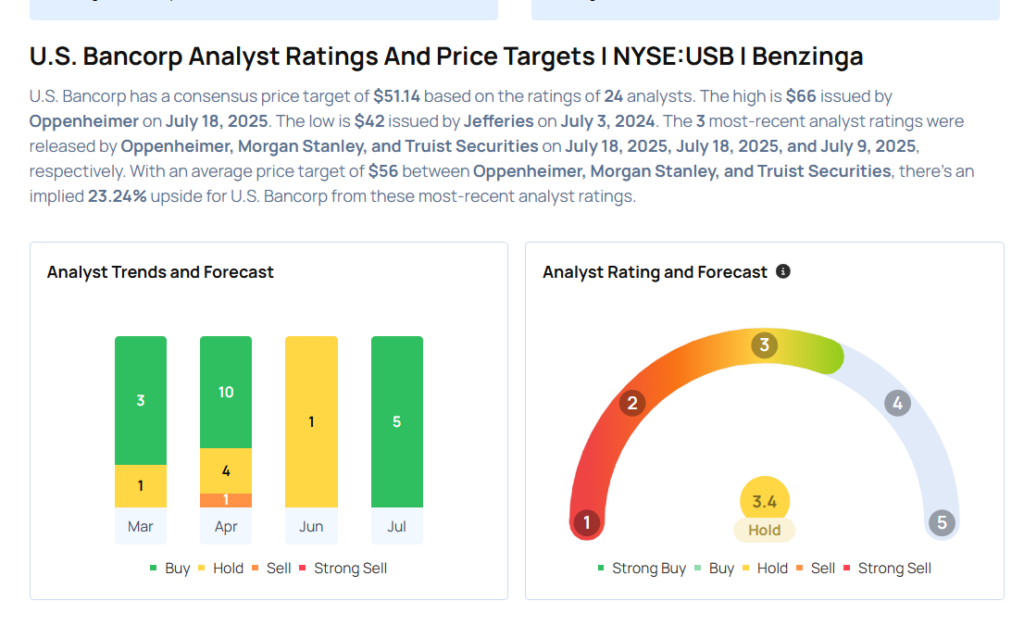

These analysts made changes to their price targets on U.S. Bancorp following earnings announcement.

- Morgan Stanley analyst Betsy Graseck maintained U.S. Bancorp with an Overweight rating and raised the price target from $51 to $52.

- Oppenheimer analyst Chris Kotowski maintained the stock with an Outperform rating and raised the price target from $65 to $66.

Considering buying USB stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for USB

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Jefferies | Downgrades | Buy | Hold |

| Jan 2022 | Odeon Capital | Upgrades | Hold | Buy |

| Jan 2022 | Keefe, Bruyette & Woods | Downgrades | Outperform | Market Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesNews Price Target Markets Analyst Ratings Trading Ideas