Snap-on Analysts Boost Their Forecasts After Better-Than-Expected Q2 Earnings

Snap-On Inc. (NYSE:SNA) reported better-than-expected second-quarter 2025 results, surpassing both revenue and earnings consensus estimates on Thursday.

Quarterly net sales reached $1.179 billion flat year-over-year increase and above the consensus estimate of $1.16 billion. EPS for the quarter was $4.72, down from $5.07 YoY, above the consensus of $4.67.

“We’re encouraged by our second quarter results, from the return of sales growth in the U.S. Tools Group to the resilient gross margins and solid operating earnings performance of the overall enterprise, all achieved against the persistent headwinds of general uncertainty and trade turbulence,” said Nick Pinchuk, Snap-on chairman and chief executive officer. “During the period, we maintained our actions to overcome the continued variation in confidence among vehicle repair technicians, driving the product-development, manufacturing and marketing programs that enabled our pivot to quick payback items, gaining significant traction in matching current customer preferences and reestablishing positive momentum in the quarter.”

For 2025, Snap-on expects continued growth in 2025, expanding its professional customer base in automotive repair and adjacent markets, with projected capital expenditures of $100 million. The company anticipates a full-year 2025 effective income tax rate between 22% and 23%.

Snap-On shares gained 7.9% to close at $337.80 on Thursday.

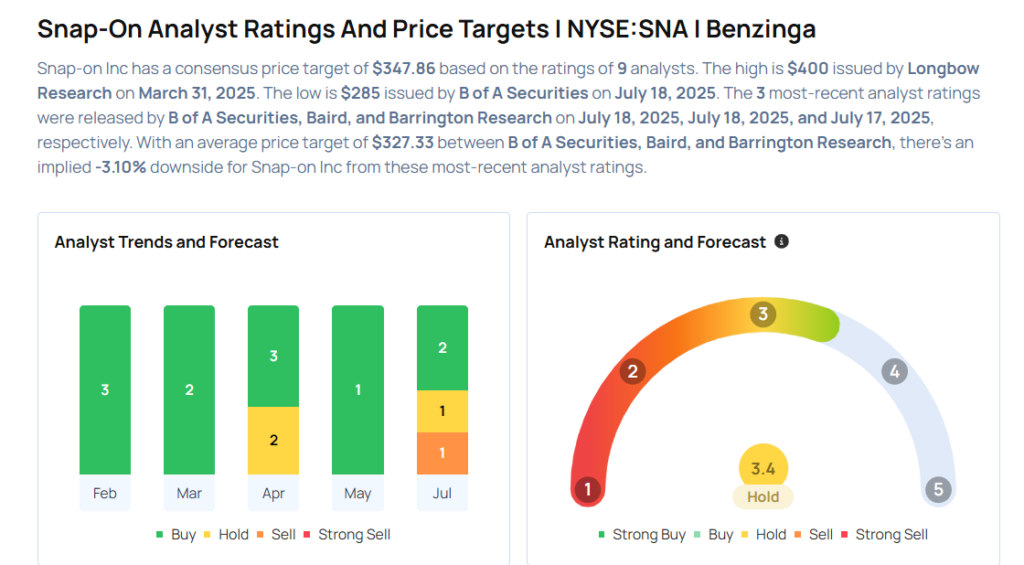

These analysts made changes to their price targets on Snap-On following earnings announcement.

- Baird analyst Luke Junk maintained Snap-on with a Neutral and raised the price target from $329 to $347.

- B of A Securities analyst Elizabeth Suzuki maintained the stock with an Underperform rating and raised the price target from $265 to $285.

Considering buying SNA stock? Here’s what analysts think:

Photo via Shutterstock

Latest Ratings for SNA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Sep 2021 | B of A Securities | Downgrades | Neutral | Underperform |

| Jun 2021 | Baird | Maintains | Neutral | |

| Oct 2020 | Baird | Reinstates | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas