Lockheed Martin Likely To Report Lower Q2 Earnings; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Lockheed Martin Corporation (NYSE:LMT) will release earnings results for the second quarter, before the opening bell on Tuesday, July 22.

Analysts expect the Bethesda, Maryland -based company to report quarterly earnings at $6.57 per share, down from $7.11 per share in the year-ago period. Lockheed Martin projects to report quarterly revenue at $18.58 billion, compared to $18.12 billion a year earlier, according to data from Benzinga Pro.

Lockheed Martin is in preliminary discussions with several companies to utilize its two eastern Pacific licenses. These licenses, secured from US regulators in the early 1980s, have recently garnered significant interest from undersea mining groups, despite never being utilized, reported the Financial Times.

Lockheed Martin shares fell 1.1% to close at $463.96 on Friday.

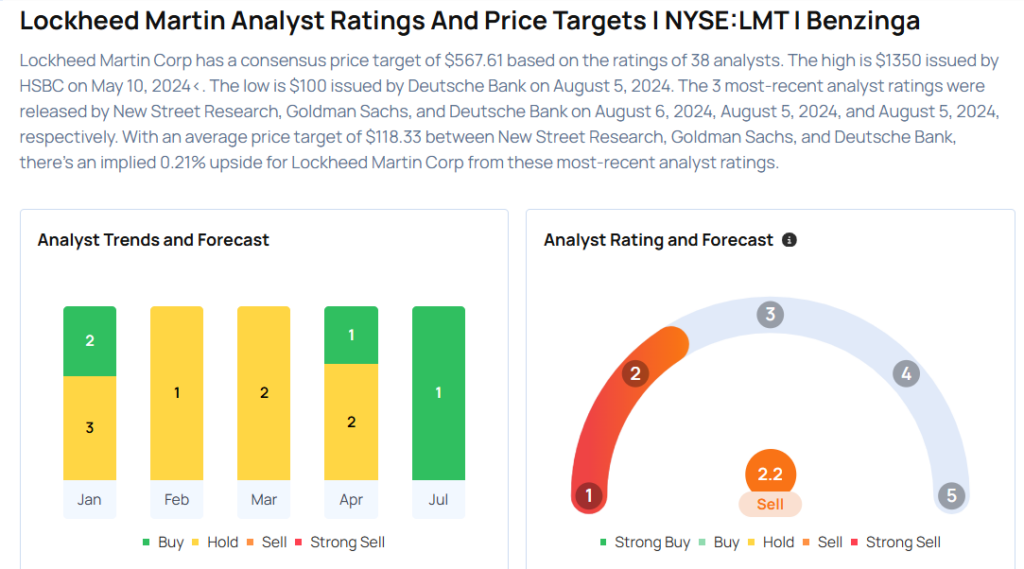

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Truist Securities analyst Michael Ciarmoli maintained a Buy rating and cut the price target from $579 to $554 on July 11, 2025. This analyst has an accuracy rate of 85.

- TD Cowen analyst Gautam Khanna downgraded the stock from Buy to Hold and cut the price target from $500 to $480 on July 10, 2025. This analyst has an accuracy rate of 79%.

- UBS analyst Gavin Parsons maintained a Neutral rating and increased the price target from $481 to $499 on April 23, 2025. This analyst has an accuracy rate of 67%.

- Baird analyst Peter Arment upgraded the stock from Neutral to Outperform with a price target of $540 on April 23, 2025. This analyst has an accuracy rate of 86%.

- Wells Fargo analyst Matthew Akers maintained an Equal-Weight rating and cut the price target from $476 to $432 on April 8, 2025. This analyst has an accuracy rate of 75%.

Considering buying LMT stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for LMT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wells Fargo | Maintains | Equal-Weight | |

| Mar 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | Wolfe Research | Upgrades | Peer Perform | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Most Accurate AnalystsEarnings News Price Target Markets Analyst Ratings Trading Ideas