These Analysts Revise Their Forecasts On General Motors After Q2 Results

General Motors Company (NYSE:GM) reported better-than-expected quarterly earnings on Tuesday.

The auto behemoth registered second-quarter adjusted earnings per share of $2.53, beating the analyst consensus estimate of $2.40. Quarterly sales of $47.12 billion outpaced the Street view of $45.57 billion.

"In the United States, we continue to lead the industry in full-size trucks and SUVs, and the 10 all-new or redesigned crossover SUVs we have introduced like the Chevrolet Trax, Buick Envista, and GMC Acadia took huge leaps forward in design and technology, resulting in record demand and revenue growth, while reduced complexity contributed to stronger profitability," said CEO Mary Barra in the company's letter to shareholders.

General Motors affirms FY25 adjusted earnings per share guidance of $8.25-$10.00 versus $9.17 analyst estimate. General Motors is keeping its full‑year 2025 guidance unchanged while planning to offset at least 30% of the $4 billion–$5 billion gross tariff impact.

General Motors shares gained 6.9% to trade at $52.26 on Wednesday.

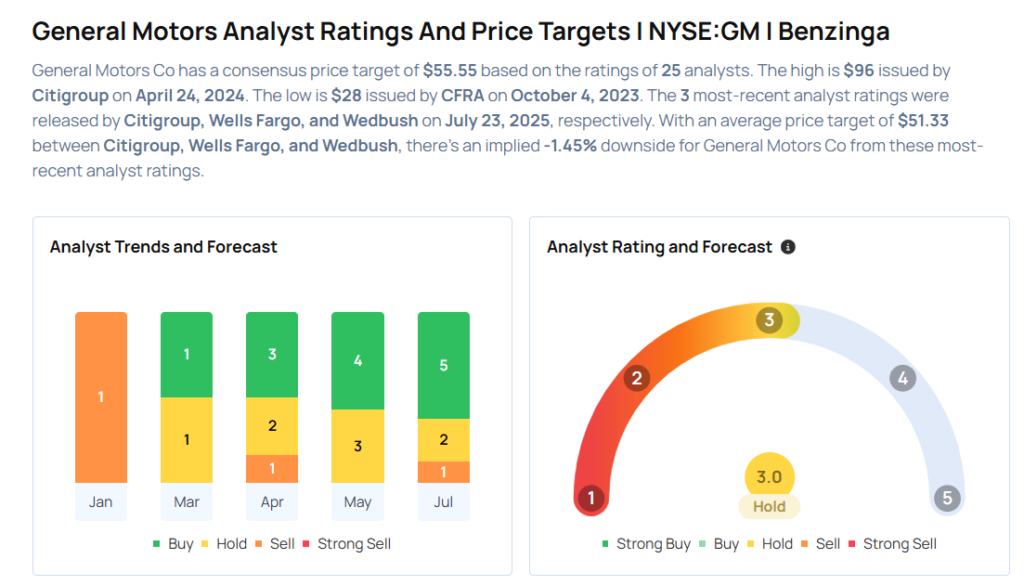

These analysts made changes to their price targets on General Motors following earnings announcement.

- B of A Securities analyst John Murphy maintained General Motors with a Buy and lowered the price target from $65 to $62.

- Wells Fargo analyst Colin Langan maintained the stock with an Underweight rating and raised the price target from $34 to $38.

- Citigroup analyst Michael Ward maintained General Motors with a Buy and raised the price target from $59 to $61.

Considering buying GM stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for GM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Benchmark | Maintains | Buy | |

| Feb 2022 | Nomura Instinet | Downgrades | Buy | Neutral |

| Feb 2022 | Morgan Stanley | Downgrades | Overweight | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas