These Analysts Boost Their Forecasts On Labcorp Following Better-Than-Expected Q2 Earnings

Labcorp Holdings Inc. (NYSE:LH) on Thursday reported stronger-than-expected results for the second quarter.

The company posted second-quarter 2025 adjusted earnings per share of $4.35, up from $3.94 a year ago, beating the consensus of $4.17. Sales increased 9.5% year-over-year to $3.53 billion, beating the consensus of $3.485 billion.

LabCorp raised its fiscal year 2025 adjusted earnings guidance from $15.70-$16.40 to $16.05-$16.50, compared to the consensus of $16.09. The company also raised 2025 sales guidance from $13.978 billion-$14.148 billion to $14.08 billion-$14.23 billion compared to the consensus of $13.897 billion. LabCorp forecasts 2025 sales growth of 7.5%-8.6% compared to prior guidance of 6.7%-8%.

“Labcorp had a very strong second quarter, delivering double-digit topline growth, while expanding margins across both segments,” said Adam Schechter, chairman and CEO of Labcorp. “We brought innovative tests to market, and applied our leadership in science and technology to drive growth, enhance the customer experience and improve our operations. We remain committed to delivering sustained value to our customers, employees and shareholders as we execute on our long-term strategy. Based upon our performance in the first half and our momentum going into the second half of the year, we’re raising our guidance.”

Labcorp shares gained 6.9% to trade at $267.69 on Friday.

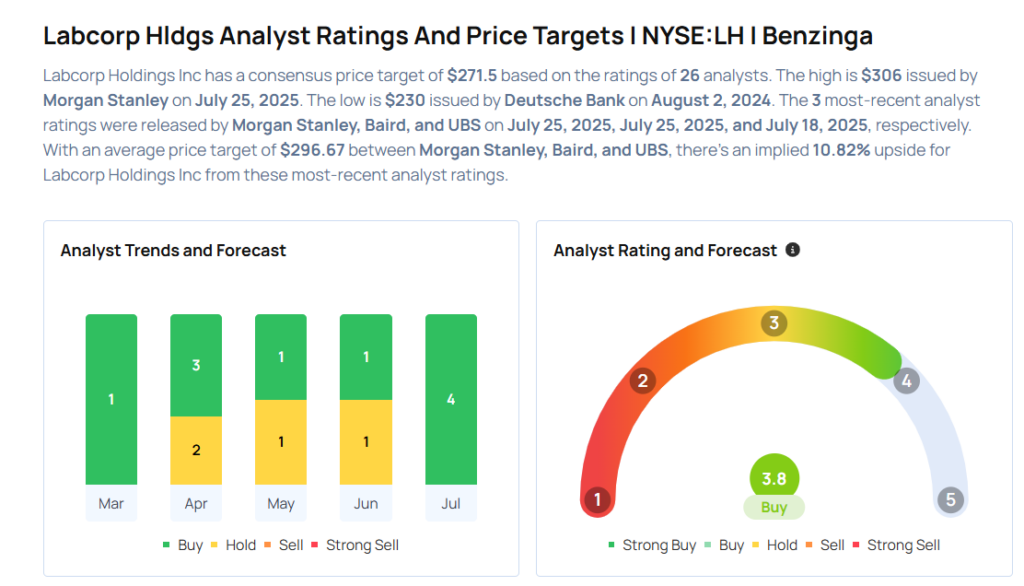

These analysts made changes to their price targets on Labcorp following earnings announcement.

- Baird analyst Eric Coldwell maintained Labcorp with an Outperform rating and raised the price target from $290 to $302.

- Morgan Stanley analyst Ricky Goldwasser maintained the stock with an Overweight rating and raised the price target from $283 to $306.

Considering buying LH stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for LH

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | Credit Suisse | Maintains | Outperform | |

| Jan 2022 | Deutsche Bank | Downgrades | Buy | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas