These Analysts Slash Their Forecasts On Western Union Following Weaker-Than-Expected Q2 Earnings

Western Union Co (NYSE:WU) reported downbeat earnings for the second quarter on Monday.

The company posted quarterly earnings of 42 cents per share which missed the analyst consensus estimate of 44 cents per share. The company reported quarterly sales of $1.026 billion which missed the analyst consensus estimate of $1.040 billion

“We continue to execute against our Evolve 2025 strategy, delivering a respectable quarter despite increased macroeconomic and political uncertainty,” said Devin McGranahan, President and Chief Executive Officer. “Our diversified business model, resilient customer base, and keen focus on operational efficiencies highlight the flexibility of our business even in this difficult operating environment.”

Western Union shares fell 3.2% to trade at $8.17 on Tuesday.

These analysts made changes to their price targets on Western Union following earnings announcement.

- Susquehanna analyst James Friedman maintained Western Union with a Neutral and lowered the price target from $11 to $9.

- Keefe, Bruyette & Woods analyst Sanjay Sakhrani maintained Western Union with a Market Perform and lowered the price target from $11 to $10.

- UBS analyst Timothy Chiodo maintained the stock with a Neutral and lowered the price target from $10.5 to $8.5.

- RBC Capital analyst Daniel Perlin maintained Western Union with a Sector Perform and cut the price target from $13 to $9.

- Morgan Stanley analyst James Faucette maintained the stock with an Underweight rating and lowered the price target from $9 to $7.

- JP Morgan analyst Tien-Tsin Huang maintained Western Union with an Underweight rating and slashed the price target from $11 to $9.

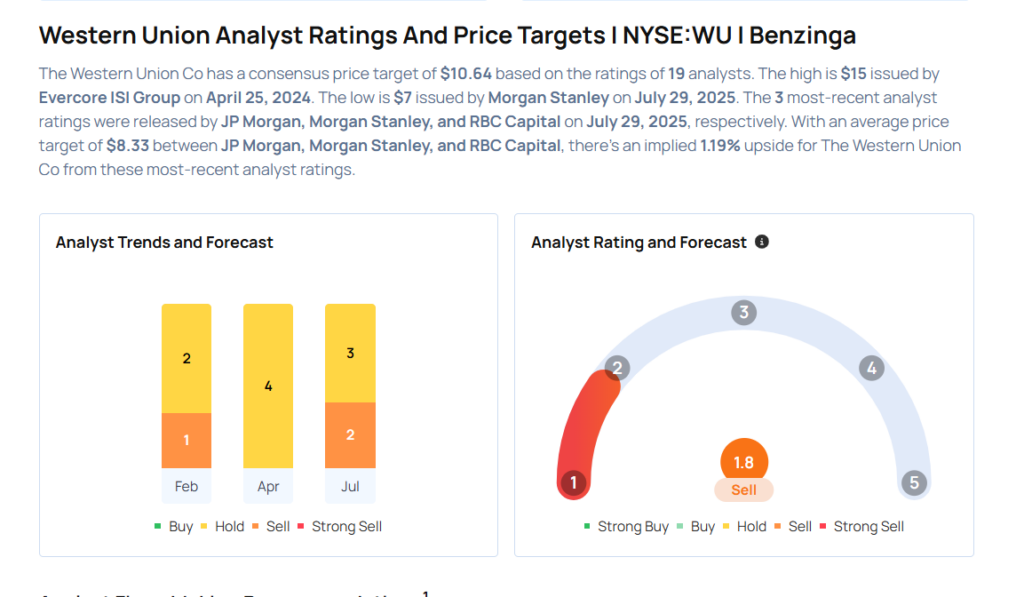

Considering buying WU stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for WU

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Citigroup | Maintains | Buy | |

| Jan 2022 | B of A Securities | Downgrades | Buy | Underperform |

| Nov 2021 | Credit Suisse | Maintains | Underperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas