Automatic Data Processing Gears Up For Q4 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Automatic Data Processing, Inc. (NASDAQ:ADP) will release earnings results for the fourth quarter before the opening bell on Wednesday, July 30.

Analysts expect the Roseland, New Jersey-based company to report quarterly earnings at $2.23 per share, up from $2.09 per share in the year-ago period. Automatic Data Processing is projected to report quarterly revenue of $5.05 billion, compared to $4.77 billion a year earlier, according to data from Benzinga Pro.

On April 23, the company reported third-quarter revenues of $5.55 billion, beating the analyst consensus estimate of $5.49 billion.

Automatic Data Processing shares rose 0.6% to close at $308.64 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

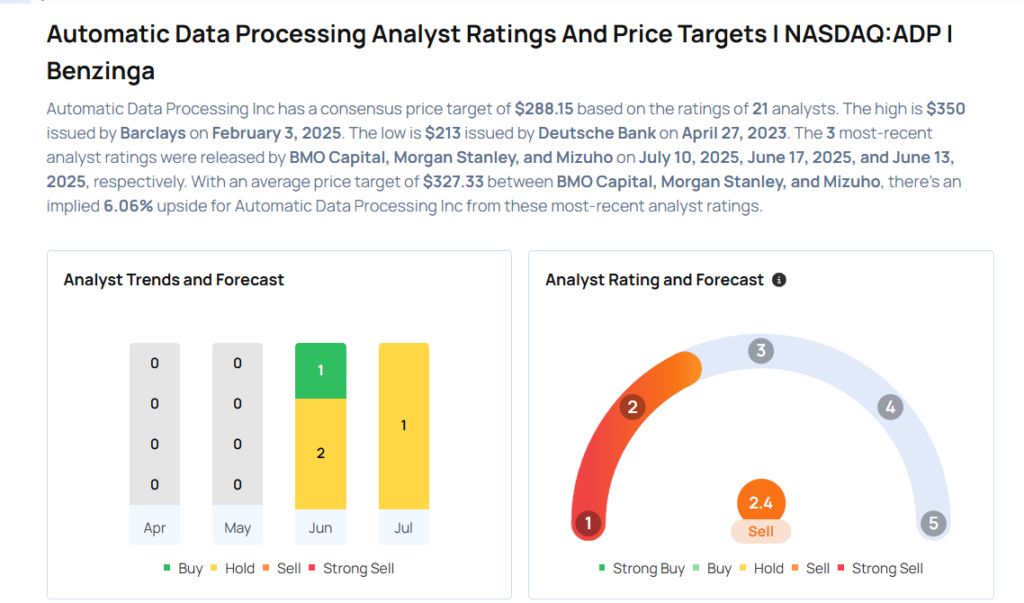

- BMO Capital analyst Daniel Jester initiated coverage on the stock with a Market Perform rating and a price target of $340 on July 10, 2025. This analyst has an accuracy rate of 69%.

- Morgan Stanley analyst James Faucette maintained an Equal-Weight rating and raised the price target from $305 to $310 on June 17, 2025. This analyst has an accuracy rate of 65%.

- Mizuho analyst Dan Dolev maintained an Outperform rating and increased the price target from $321 to $332 on June 13, 2025. This analyst has an accuracy rate of 70%.

- RBC Capital analyst Ashish Sabadra reiterated a Sector Perform rating with a price target of $315 on June 5, 2025. This analyst has an accuracy rate of 74%.

- TD Securities analyst Bryan Bergin maintained a Hold rating and raised the price target from $298 to $321 on May 21, 2025. This analyst has an accuracy rate of 60%

Considering buying ADP stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for ADP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | B of A Securities | Upgrades | Underperform | Neutral |

| Jan 2022 | Deutsche Bank | Maintains | Hold | |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert IdeasEarnings News Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas