These Analysts Revise Their Forecasts On PayPal Following Q2 Results

PayPal Holdings (NASDAQ:PYPL) reported better-than-expected second-quarter 2025 results on Tuesday.

The company reported a quarterly revenue growth of 5% year-over-year to $8.29 billion, topping the analyst consensus estimate of $8.08 billion. The adjusted EPS was $1.40, beating the analyst consensus estimate of $1.29.

PayPal expects a third-quarter adjusted EPS of $1.18-$1.22, compared to $1.20 for the previous year's period, and the analyst consensus estimate is $1.20. PayPal expects a full-year 2025 adjusted EPS of $5.15-$5.30 (prior $4.95-$5.10), compared to $4.65 Y/Y. Current analysts estimate an EPS of $5.09.

PayPal shares fell 0.9% to trade at $70.82 on Wednesday.

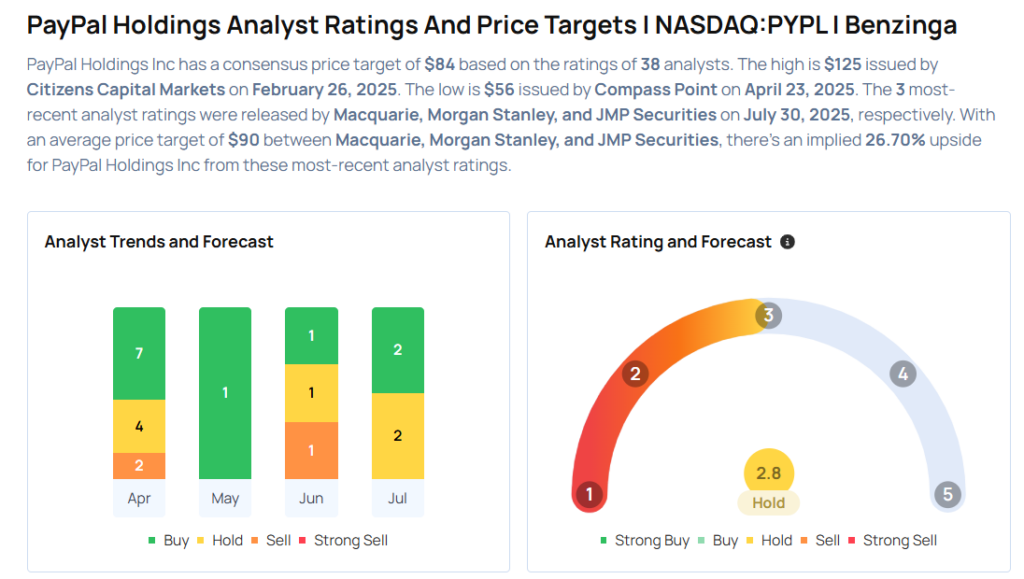

These analysts made changes to their price targets on PayPal following earnings announcement.

- JMP Securities analyst Andrew Boone maintained PayPal with a Market Outperform and lowered the price target from $110 to $100.

- Morgan Stanley analyst James Faucette maintained the stock with an Equal-Weight rating and raised the price target from $74 to $75.

- Macquarie analyst Paul Golding maintained PayPal with an Outperform rating and maintained a $95 price target.

Considering buying PYPL stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for PYPL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | B of A Securities | Downgrades | Buy | Neutral |

| Feb 2022 | Mizuho | Maintains | Buy | |

| Feb 2022 | Barclays | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas