These Analysts Revise Their Forecasts On Ecolab After Q2 Results

Ecolab Inc (NYSE:ECL) reported worse-than-expected second-quarter earnings on Tuesday.

The company reported second-quarter adjusted earnings per share of $1.89 missing the analyst consensus estimate of $1.90. Quarterly sales of $4.025 billion outpaced the Street view of $4.016 billion.

"Our growth engines, which include Life Sciences, Pest Elimination, Global High-Tech and Ecolab Digital, collectively grew sales double digits, with very strong operating income growth," said Ecolab CEO Christophe Beck.

Ecolab reaffirmed its fiscal year 2025 adjusted EPS guidance in the range of $7.42 to $7.62, compared with the $7.50 analyst estimate. The company also issued third-quarter adjusted EPS guidance of between $2.02 and $2.12, compared to the $2.06 consensus.

Ecolab shares gained 2.1% to trade at $264.70 on Wednesday.

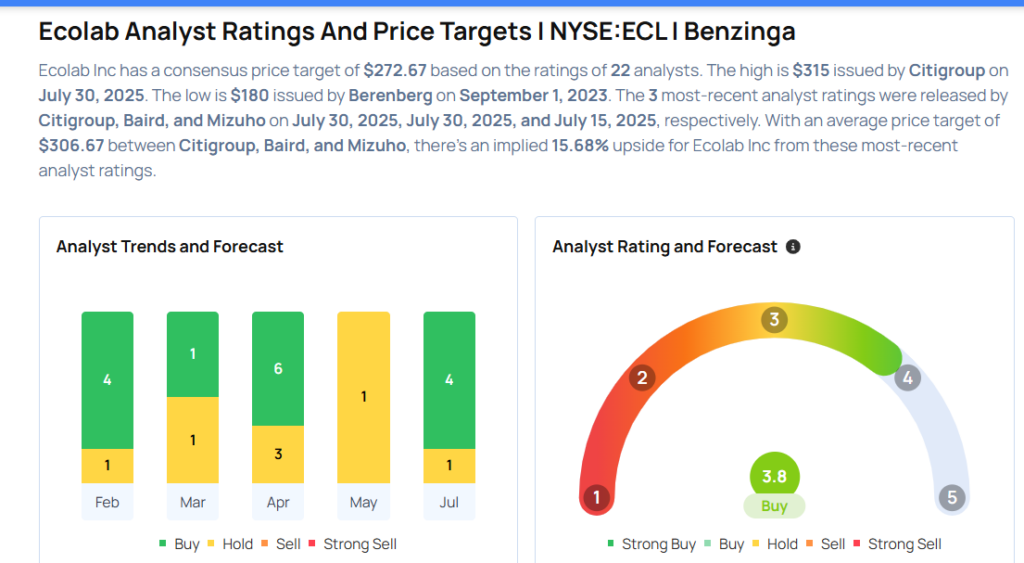

These analysts made changes to their price targets on Ecolab following earnings announcement.

- Baird analyst Andrew Wittmann upgraded Ecolab from Neutral to Outperform and raised the price target from $273 to $300.

- Citigroup analyst Patrick Cunningham maintained the stock with a Buy and lowered the price target from $320 to $315.

Considering buying ECL stock? Here’s what analysts think:

Read This Next:

Latest Ratings for ECL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Barclays | Maintains | Overweight | |

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Credit Suisse | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas