Vertiv Holdings Analysts Boost Their Forecasts After Better-Than-Expected Q2 Earnings

Vertiv Holdings Co (NYSE:VRT) reported better-than-expected second-quarter results and raised its FY25 guidance above estimates on Wednesday.

Vertiv reported quarterly earnings of 95 cents per share which beat the analyst consensus estimate of 83 cents per share. The company reported quarterly sales of $2.64 billion which beat the analyst consensus estimate of $2.35 billion.

Vertiv Holdings raised its FY2025 adjusted EPS guidance from $3.45-$3.65 to $3.75-$3.85 and also boosted its sales guidance from $9.325 billion-$9.575 billion to $9.925 billion-$10.075 billion.

“Vertiv’s second quarter performance demonstrates the strength of our market position and our ability to execute at scale,” said Giordano Albertazzi, Vertiv’s Chief Executive Officer. “Our 35% sales growth and robust orders momentum reflect both strong market demand and our expanded capabilities to serve our customers’ increasingly complex infrastructure needs. We are strategically investing in capacity expansion and accelerating our innovation pipeline to capitalize on unprecedented data center growth, particularly in AI-enabled infrastructure.”

Vertiv shares gained 2.6% to trade at $147.89 on Thursday.

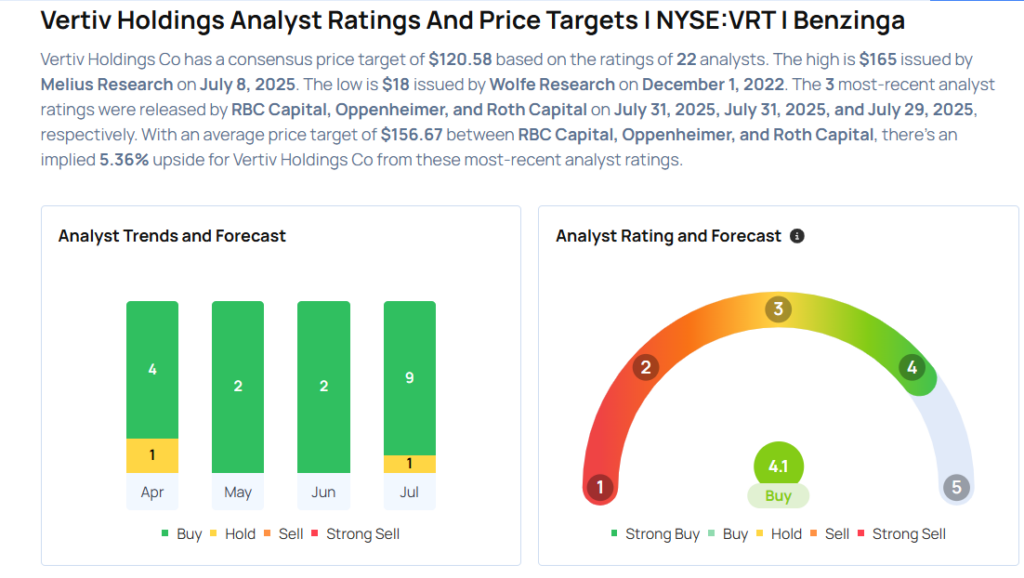

These analysts made changes to their price targets on Vertiv following earnings announcement.

- Oppenheimer analyst Noah Kaye maintained Vertiv with an Outperform rating and raised the price target from $140 to $151.

- RBC Capital analyst Deane Dray maintained the stock with an Outperform rating and raised the price target from $143 to $162.

Considering buying VRT stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for VRT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Mizuho | Maintains | Neutral | |

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Feb 2022 | Cowen & Co. | Downgrades | Outperform | Market Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas