Bio-Rad Laboratories Analysts Raise Their Forecasts After Better-Than-Expected Q2 Earnings

Bio-Rad Laboratories, Inc. (NYSE:BIO) reported better-than-expected second-quarter financial results on Thursday.

Bio-Rad Laboratories reported quarterly earnings of $2.61 per share which beat the analyst consensus estimate of $1.76 per share. The company reported quarterly sales of $651.600 million which beat the analyst consensus estimate of $615.110 million.

Bio-Rad Laboratories narrowed its FY2025 sales guidance from $2.541 billion-$2.606 billion to $2.567 billion-$2.593 billion.

Norman Schwartz, Bio-Rad’s Chairman and Chief Executive Officer, said, “In a highly dynamic environment, we delivered solid quarterly results, both in terms of revenue and operating margin, through focused execution and careful expense management. We also completed the acquisition of droplet digital PCR developer Stilla Technologies, effectively expanding our Droplet Digital™ PCR offering with the recent launch of our QX Continuum™ system complemented by the QX700™ series of acquired instruments.”

Bio-Rad Laboratories shares gained 19.5% to trade at $289.03 on Friday.

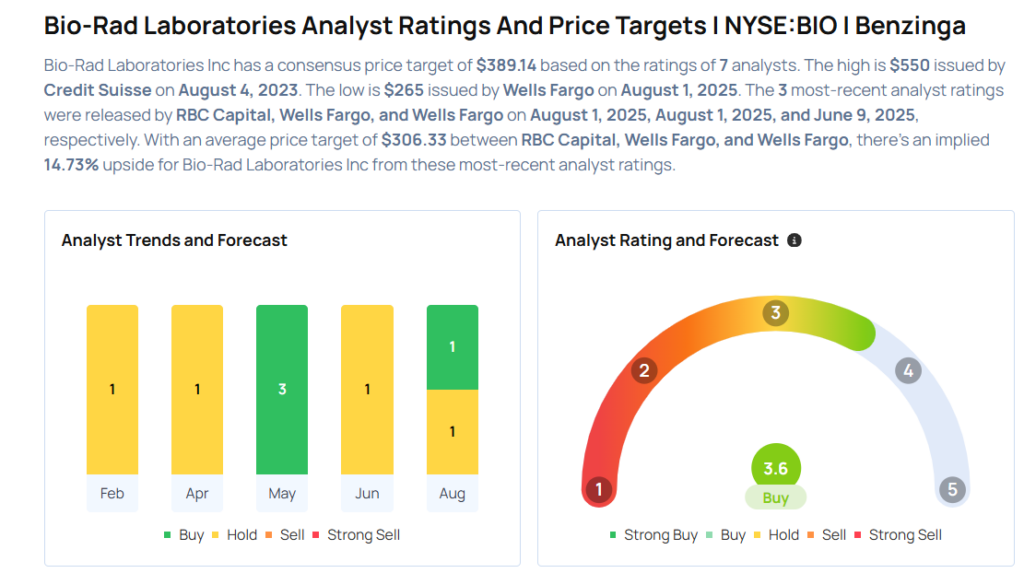

These analysts made changes to their price targets on Bio-Rad Laboratories following earnings announcement.

- Wells Fargo analyst Brandon Couillard maintained Bio-Rad Laboratories with an Equal-Weight rating and raised the price target from $245 to $265.

- RBC Capital analyst Conor McNamara maintained the stock with an Outperform rating and raised the price target from $387 to $409.

Considering buying BIO stock? Here’s what analysts think:

Photo via Shutterstock

Latest Ratings for BIO

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jul 2021 | Wells Fargo | Maintains | Overweight | |

| Feb 2021 | Citigroup | Maintains | Buy | |

| Feb 2021 | Jefferies | Maintains | Buy |

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas