These Analysts Lower Their Forecasts On Colgate-Palmolive After Q2 Results

Colgate-Palmolive Company (NYSE:CL) posted better-than-expected second-quarter earnings on Friday.

Colgate-Palmolive reported second-quarter adjusted earnings per share of 92 cents, beating the analyst consensus estimate of 89 cents. Quarterly sales of $5.11 billion (+1% year over year) outpaced the Street view of $5.03 billion.

The company continues to expect net sales to increase in the low single digits, now factoring in a flat to low-single-digit negative impact from foreign exchange. Organic sales growth is projected to be at the low end of the 2% to 4% range, reflecting the planned exit from private label pet sales over the course of 2025.

On a non-GAAP (Base Business) basis, the company still anticipates gross profit margin and advertising to remain roughly flat as a percentage of net sales, with earnings per share expected to grow in the low single digits.

Noel Wallace, Chairman, President and Chief Executive Officer, said, “I am pleased that Colgate-Palmolive people achieved another quarter of net sales, organic sales and earnings per share growth in the face of continued difficult market conditions worldwide, with organic sales growth improving sequentially versus the first quarter despite an even greater negative impact from lower private label pet sales.”

Colgate-Palmolive shares fell 0.3% to trade at $83.27 on Monday.

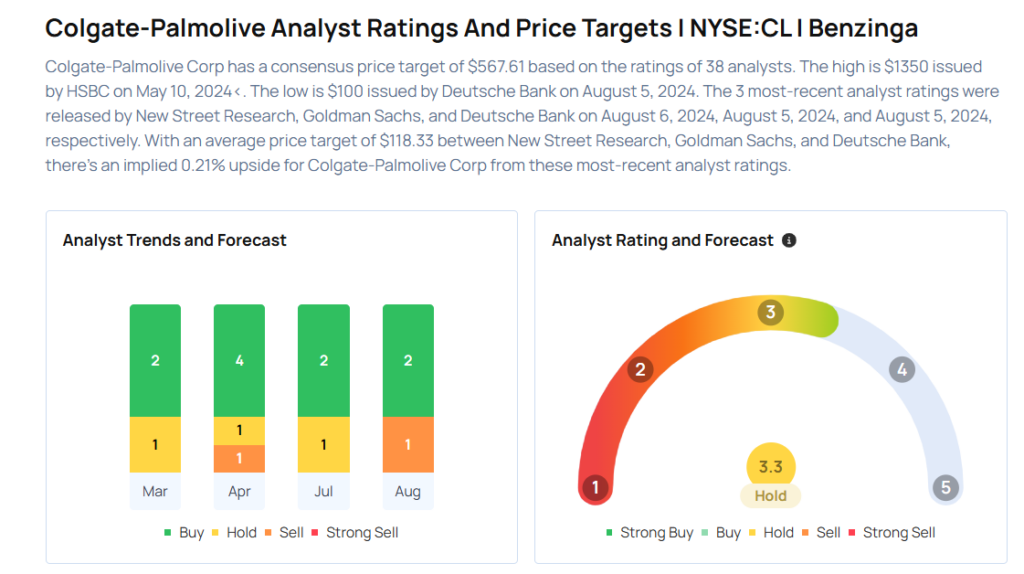

These analysts made changes to their price targets on Colgate-Palmolive following earnings announcement.

- Wells Fargo analyst Chris Carey maintained Colgate-Palmolive with an Underweight rating and lowered the price target from $88 to $83.

- Morgan Stanley analyst Dara Mohsenian maintained Colgate-Palmolive with an Overweight rating and lowered the price target from $104 to $96.

- JP Morgan analyst Andrea Teixeira maintained the stock with an Overweight rating and lowered the price target from $99 to $95.

Considering buying CL stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for CL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Bernstein | Upgrades | Underperform | Market Perform |

| Jan 2022 | Credit Suisse | Maintains | Outperform | |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas