Pinterest Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Pinterest, Inc. (NYSE:PINS) will release earnings results for the second quarter, after the closing bell on Thursday, Aug. 7.

Analysts expect the San Francisco, California-based company to report quarterly earnings at 35 cents per share, up from 29 cents per share in the year-ago period. Pinterest projects to report quarterly revenue at $975.52 million, compared to $853.68 million a year earlier, according to data from Benzinga Pro.

On May 8, Pinterest reported better-than-expected first-quarter sales results and issued second-quarter sales guidance with its midpoint above estimates.

Pinterest shares rose 0.6% to close at $39.10 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

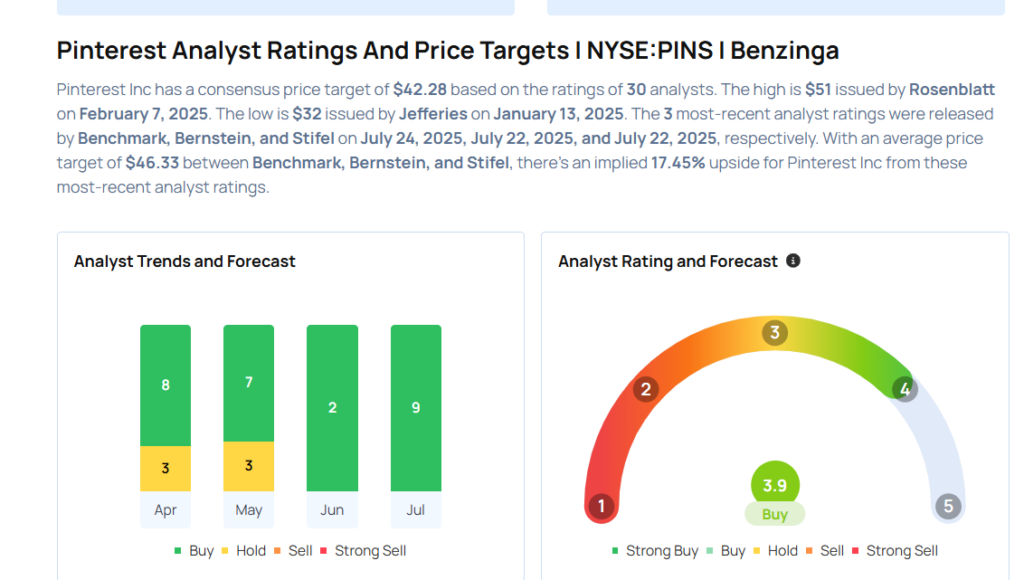

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Benchmark analyst Mark Zgutowicz maintained a Buy rating and increased the price target from $45 to $48 on July 24, 2025. This analyst has an accuracy rate of 60%.

- Bernstein analyst Mark Shmulik maintained an Outperform rating and increased the price target from $40 to $45 on July 22, 2025. This analyst has an accuracy rate of 77%.

- Stifel analyst Mark Kelley maintained a Buy rating and boosted the price target from $40 to $46 on July 22, 2025. This analyst has an accuracy rate of 84%.

- Morgan Stanley analyst Brian Nowak upgraded the stock from Equal-Weight to Overweight and raised the price target from $37 to $45 on July 21, 2025. This analyst has an accuracy rate of 68%.

- Wedbush analyst Scott Devitt maintained an Outperform rating and increased the price target from $40 to $42 on July 17, 2025. This analyst has an accuracy rate of 83%.

Considering buying PINS stock? Here’s what analysts think:

Photo via Shutterstock

Latest Ratings for PINS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Benchmark | Initiates Coverage On | Hold | |

| Feb 2022 | Credit Suisse | Maintains | Neutral | |

| Feb 2022 | UBS | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Most Accurate AnalystsEarnings News Price Target Markets Analyst Ratings Trading Ideas