These Analysts Increase Their Forecasts On AppLovin After Strong Q2 Earnings

Applovin Corp (NASDAQ:APP) posted upbeat earnings for the second quarter on Wednesday.

AppLovin reported second-quarter revenue of $1.26 billion, missing analyst estimates of $1.31 billion, according to Benzinga Pro. The company reported second-quarter earnings of $2.39 per share, beating analyst estimates of $2.04 per share.

Applovin shares jumped 13.2% to $442.10 on Thursday.

These analysts made changes to their price targets on Applovin following earnings announcement.

- Piper Sandler analyst James Callahan maintained AppLovin with an Overweight rating and raised the price target from $470 to $500.

- Wells Fargo analyst Alec Brondolo maintained AppLovin with an Overweight rating and raised the price target from $405 to $480.

- Morgan Stanley analyst Matthew Cost maintained the stock with an Overweight rating and raised the price target from $460 to $480.

- Scotiabank analyst Nat Schindler maintained AppLovin with a Sector Outperform and raised the price target from $430 to $450.

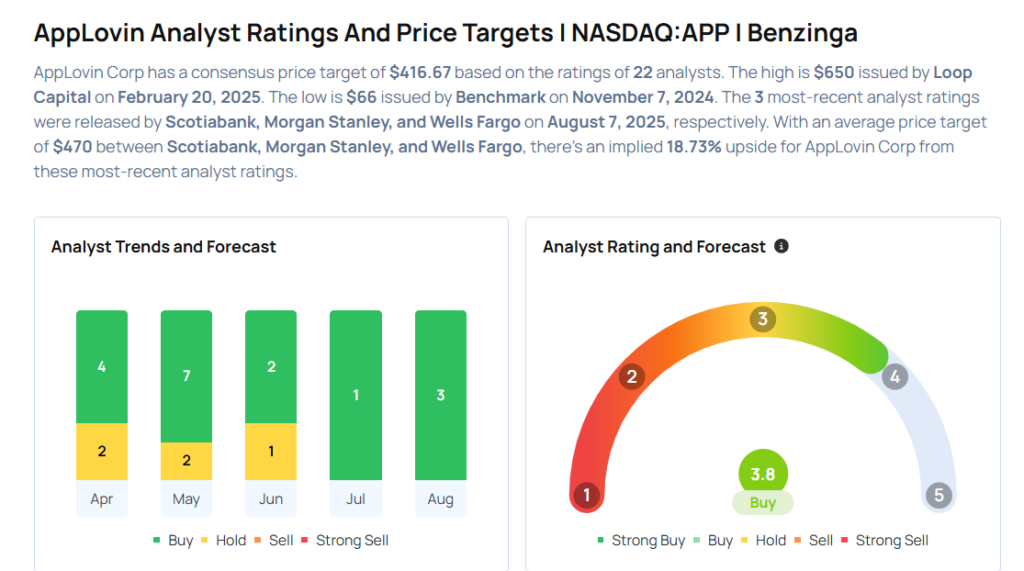

Considering buying APP stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for APP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | Credit Suisse | Maintains | Outperform | |

| Feb 2022 | Credit Suisse | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesNews Price Target Markets Analyst Ratings Trading Ideas