These Analysts Revise Their Forecasts On Wix.com Following Q2 Results

Wix.com Ltd. (NASDAQ:WIX) reported better-than-expected second-quarter adjusted EPS and sales on Wednesday.

The quarterly revenue grew 12% year-over-year (Y/Y) to $489.93 million, topping the analyst consensus estimate of $487.47 million. Adjusted EPS of $2.28 beat the analyst consensus estimate of $1.74.

"Our strong first-half performance reinforces our confidence in accelerating growth throughout the remainder of 2025, supported by a stable and positive macroeconomic environment. Strong momentum in the core Wix business, driven by new cohort outperformance, is further bolstered by our entry into a new rapidly-growing TAM through our recent acquisition of Base44," the company said in a press release.

Wix.com revised its fiscal 2025 revenue outlook to $1.975 billion-$2.000 billion (prior $1.97 billion-$2.00 billion)versus the analyst consensus estimate of $1.987 billion and bookings of $2.040 billion-$2.075 billion(prior $2.03 billion-$2.06 billion).

Wix.com expects third-quarter fiscal 2025 revenue of $498.00 million-$504.00 million versus the analyst consensus estimate of $502.33 million.

Wix.com shares gained 6.5% to $136.79 on Thursday.

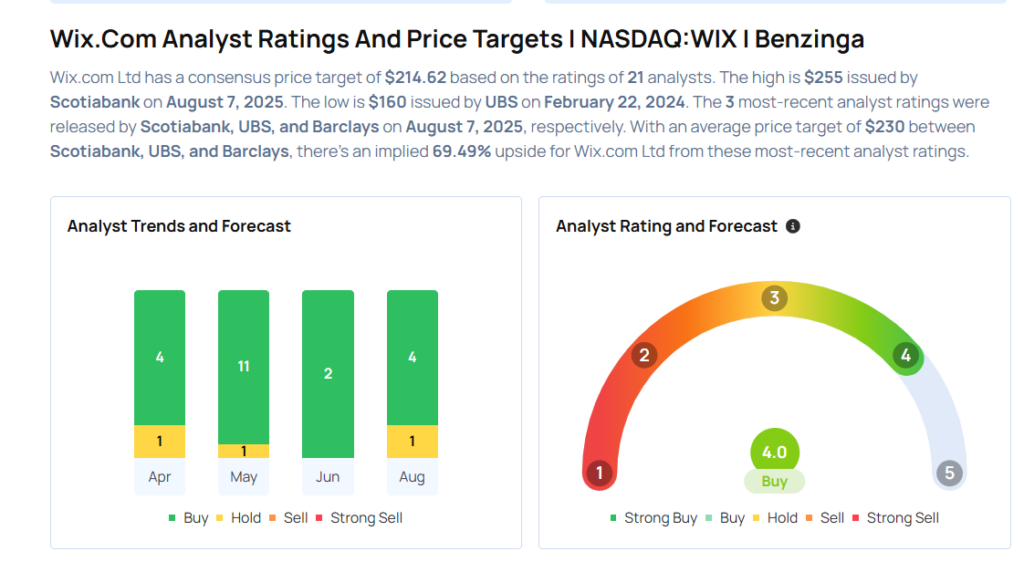

These analysts made changes to their price targets on Wix.com following earnings announcement.

- Needham analyst Bernie McTernan maintained Wix.com with a Buy and lowered the price target from $250 to $200.

- Raymond James analyst Josh Beck maintained the stock with a Strong Buy and lowered the price target from $250 to $200.

- Barclays analyst Trevor Young maintained Wix.com with an Overweight rating and lowered the price target from $240 to $235.

- UBS analyst Chris Zhang maintained Wix.com with a Buy and lowered the price target from $230 to $200.

- Scotiabank analyst Nat Schindler maintained the stock with a Sector Outperform and raised the price target from $250 to $255.

Considering buying WIX stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for WIX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Atlantic Equities | Downgrades | Overweight | Neutral |

| Feb 2022 | RBC Capital | Maintains | Sector Perform | |

| Feb 2022 | JMP Securities | Maintains | Market Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Analyst Ratings Trading Ideas