Expedia Analysts Boost Their Forecasts After Upbeat Q2 Results

Expedia Group Inc (NASDAQ:EXPE) reported better-than-expected second-quarter financial results and issued third-quarter revenue guidance above estimates.

Expedia reported second-quarter revenue of $3.79 billion, up 6% year-over-year. The revenue beat a Street consensus estimate of $3.70 billion, according to data from Benzinga Pro. Earnings per share of $4.24 beat a Street consensus estimate of $3.90.

“We delivered a solid second quarter, surpassing our top and bottom-line expectations while navigating a dynamic environment,” Expedia Group CEO Ariane Gorin said.

The company raised its full-year guidance to a new range of $14.10 billion to $14.38 billion. The Street consensus estimate if $14.15 billion according to data from Benzinga Pro.

For the third quarter, the company sees revenue coming in a range of $4.22 billion to $4.30 billion.

Expedia shares closed at $187.61 on Thursday.

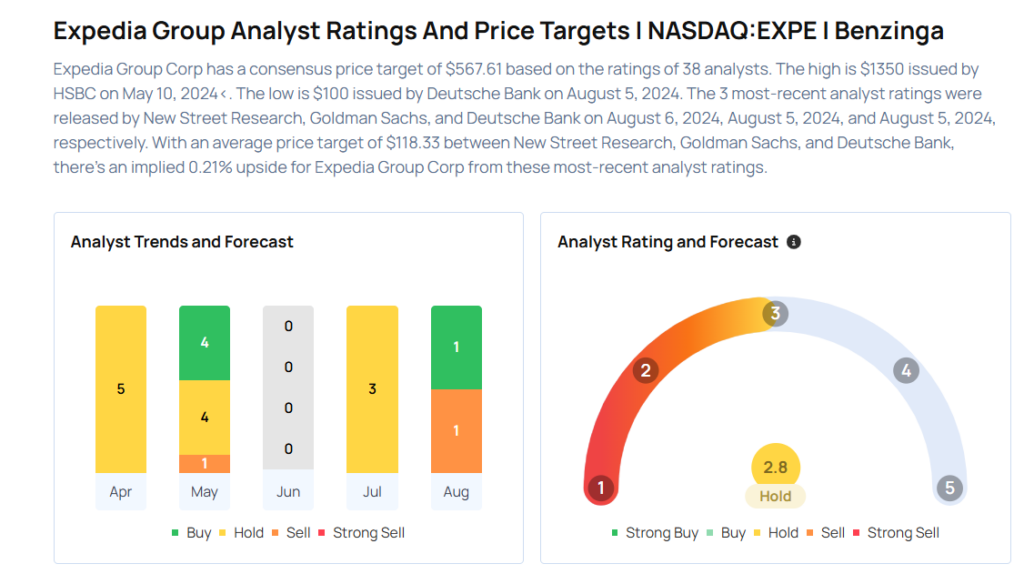

These analysts made changes to their price targets on Expedia following earnings announcement.

- B of A Securities analyst Justin Post maintained Expedia with a Buy and raised the price target from $211 to $240.

- Piper Sandler analyst Thomas Champion maintained the stock with an Underweight rating and raised the price target from $135 to $190.

Considering buying EXPE stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for EXPE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Buy | |

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Citigroup | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas