Microchip Technology Analysts Increase Their Forecasts After Better-Than-Expected Q1 Results

Microchip Technology (NASDAQ:MCHP) reported better-than-expected earnings for the first quarter on Thursday.

The company posted quarterly earnings of 27 cents per share which beat the analyst consensus estimate of 23 cents per share. The company reported quarterly sales of $1.075 billion which beat the analyst consensus estimate of $1.054 billion.

Microchip Technology said it sees second-quarter adjusted EPS of 34 cents to 37 cents per share, versus market estimates of 30 cents per share. The company projects sales of $1.110 billion to $1.150 billion versus expectations of $1.115 billion.

Steve Sanghi, Microchip’s CEO and President said, “Fiscal 2026 is off to a strong start as revenue grew 10.8% sequentially to approximately $1.0755 billion, well ahead of our revised guidance. As we execute our strategic imperatives under our nine-point recovery plan, we are seeing improvements across key financial metrics and emerging from the prolonged industry downturn with enhanced operational capabilities and a strengthened financial position. The momentum from the March quarter has accelerated into fiscal 2026, validating our strategic plan and positioning us well to capitalize on the recovery.”

Microchip Technology shares closed at $66.22 on Thursday.

These analysts made changes to their price targets on Atlassian following earnings announcement.

- Needham analyst N. Quinn Bolton maintained Microchip Technology with a Buy and raised the price target from $66 to $77.

- Piper Sandler analyst Harsh Kumar maintained the stock with an Overweight rating and raised the price target from $65 to $80.

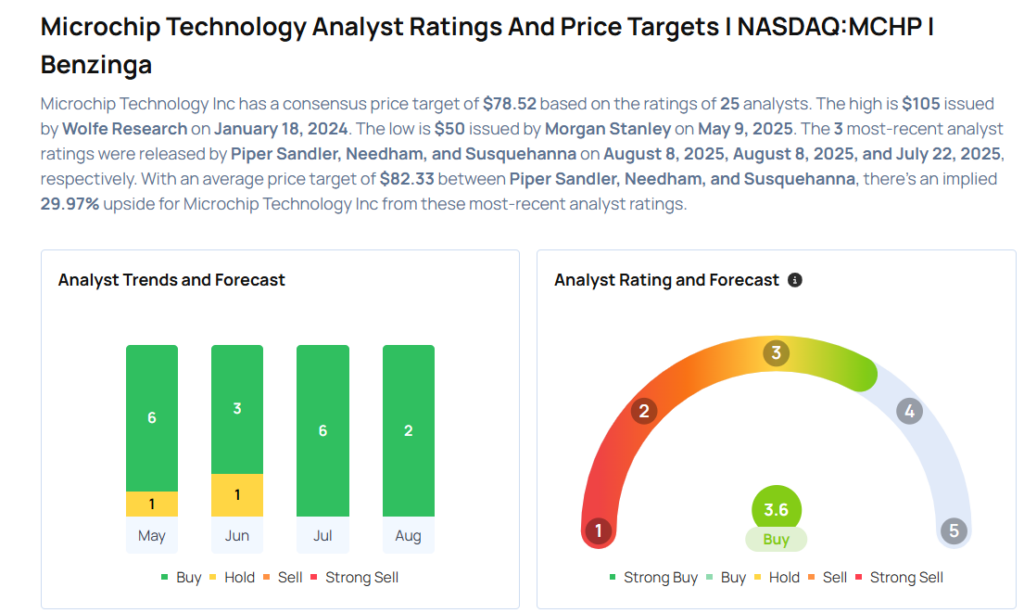

Considering buying MCHP stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for MCHP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | UBS | Maintains | Buy | |

| Feb 2022 | Rosenblatt | Maintains | Buy | |

| Jan 2022 | UBS | Upgrades | Neutral | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas