These Analysts Slash Their Forecasts On Haemonetics After Q1 Results

Haemonetics Corp (NYSE:HAE) reported upbeat earnings for the first quarter on Thursday.

The company posted quarterly earnings of $1.10 per share which beat the analyst consensus estimate of $1.02 per share. The company reported quarterly sales of $321.394 million which beat the analyst consensus estimate of $305.115 million.

Haemonetics affirmed FY2026 adjusted EPS guidance of $4.70 to $5.00.

Haemonetics shares closed at $55.63 on Thursday.

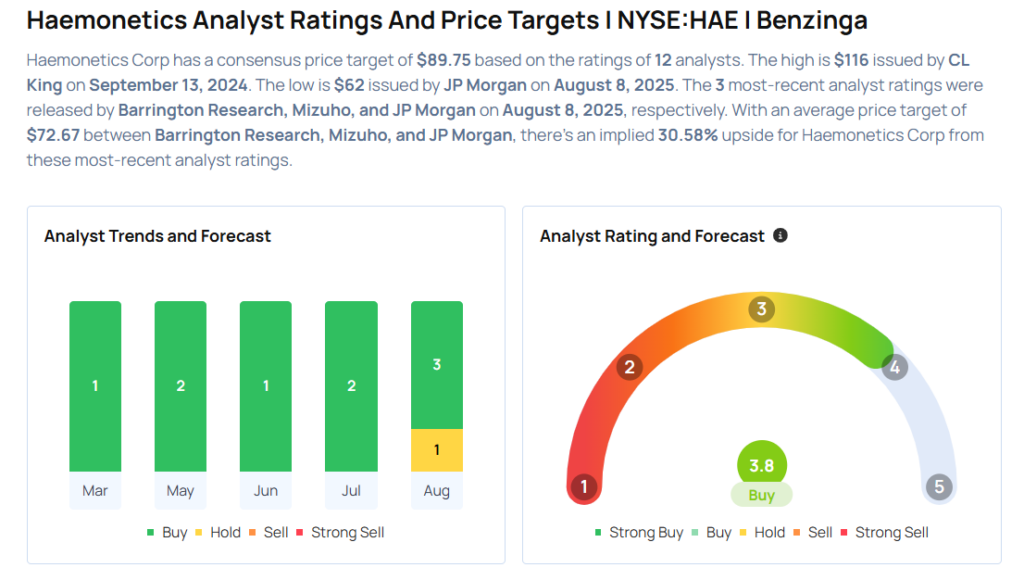

These analysts made changes to their price targets on Haemonetics following earnings announcement.

- JP Morgan analyst Rohin Patel downgraded Haemonetics from Overweight to Neutral and lowered the price target from $85 to $62.

- Mizuho analyst Anthony Petrone maintained Haemonetics with an Outperform rating and lowered the price target from $90 to $70.

- Barrington Research analyst Michael Petusky maintained the stock with an Outperform rating and lowered the price target from $95 to $86.

Considering buying HAE stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for HAE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Raymond James | Maintains | Outperform | |

| Jan 2022 | Needham | Downgrades | Buy | Hold |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas