Flutter Entertainment Analysts Boost Their Forecasts After Upbeat Q2 Results

Flutter Entertainment PLC (NYSE:FLUT) reported better-than-expected second-quarter financial results after market close Thursday.

Flutter reported second-quarter revenue of $4.19 billion, up 16% year-over-year. The revenue total beat the Street consensus estimates of $4.06 billion according to data from Benzinga Pro.

The company reported adjusted earnings per share of $2.95, beating a Street consensus estimate of $2.05.

“I am pleased with the excellent underlying performance we have delivered in the second quarter alongside the good progress made on a number of key strategic initiatives,” Flutter CEO Peter Jackson said. “Revenue grew by 16% year-on-year, as we continue to build scale positions in the most attractive markets through strong organic growth and value creating M&A.”

The company is raising its full-year guidance for revenue and adjusted EBITDA. Flutter expects revenue of $17.26 billion, up 23% year-over-year, versus a prior guidance of $17.08 billion. The company expects adjusted EBITDA of $3.295 billion, up from a previous guidance of $3.18 billion.

Flutter Entertainment shares closed at $306.07 on Thursday.

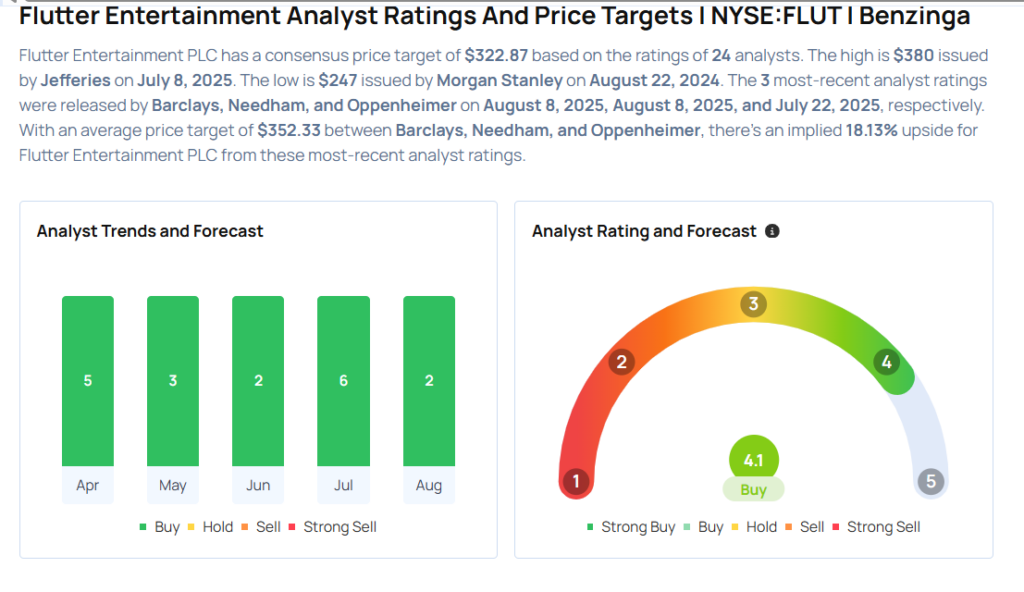

These analysts made changes to their price targets on Flutter Entertainment following earnings announcement.

- Needham analyst Bernie McTernan maintained Flutter Entertainment with a Buy and raised the price target from $340 to $355.

- Barclays analyst Brandt Montour maintained the stock with an Overweight rating and raised the price target from $350 to $352.

Considering buying FLUT stock? Here’s what analysts think:

Read This Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas