Coinbase Crushed Tesla, Amazon And Other Mag 7 Peers In Recent Rally — Here's What Drove The Stunning Comeback

Cryptocurrency exchange Coinbase Global Inc. overtook several Wall Street behemoths in a stunning rally last month, driven by its historic inclusion in the S&P 500 and renewed cryptocurrency optimism.

What happened: The Nasdaq-listed company soared nearly 30% in the last month, marking a sharp reversal from its meltdown in April. The firm's stock was up 70% since its yearly low of $151.47.

In doing so, COIN outgained some of the biggest technology companies on the planet. As evident, its returns over the last month beat Amazon, Google's parent company Alphabet, electric vehicle juggernaut Tesla and all the other stocks in the high-performing "Magnificent 7" cohort.

Asset

1-Month Gains

Coinbase Global Inc. (NASDAQ:COIN)

29.84%

NVIDIA Corp. (NASDAQ:NVDA)

24.07%

Tesla, Inc. (NASDAQ:TSLA)

22.84%

Meta Platforms Inc. (NASDAQ:META)

11.28%

Amazon.com Inc. (NASDAQ:AMZN)

10.39%

Microsoft Corp. (NASDAQ:MSFT)

6.14%

Apple Inc. (NASDAQ:AAPL)

2.20%

Alphabet Inc. (NASDAQ:GOOGL)

1.20%

Additionally, the Roundhill Magnificent Seven ETF (BATS:MAGS), which offers equal-weight exposure to the “Mag 7” stocks, underperformed Coinbase, returning only 11.19% over the past month.

See Also: Forget Dollars: Willy Woo Says Bitcoin Will Be Priced Against Global GDP — ‘Gold Used To Be That Money, BTC Is The Challenger’

Coinbase made history last month after it became the first pure-play cryptocurrency stock to join the S&P 500 Index, the widely used benchmark for the U.S. stock market.

The firm also made a big push into the global crypto derivatives market by acquiring crypto options exchange Deribit for approximately $2.9 billion in a cash-and-stock deal. Once completed, the deal will make Coinbase the largest cryptocurrency derivatives platform in terms of open interest and options volume.

Further upsides were driven by the recovery of the cryptocurrency market, with Bitcoin (CRYPTO: BTC) embarking on a record-breaking rally.

Price Action: Shares of Coinbase rose 0.19% in after-hours trading after closing 4.94% higher at $258.91 during Tuesday’s regular trading session, according to data from Benzinga Pro. Year-to-date, the stock has gained 4.27%.

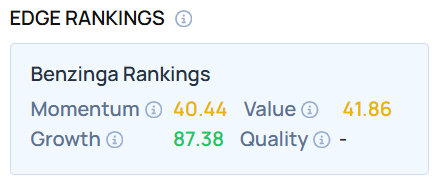

As of this writing, COIN ranked high on growth, an indicator of a stock's combined historical expansion in earnings and revenue across multiple periods. To check how other cryptocurrency-linked stocks stack up against COIN, visit Benzinga Edge Stock Rankings.

Read Next:

Image Via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Coinbase KeyProj magnificent 7Cryptocurrency News Markets