Bitcoin Miner IREN Could Surge 1,572% As SOTP Valuation Pegs $300 Target — Hedge Fund Manager Eric Jackson Says, 'We're Cooking With Gas'

IREN Ltd. (NASDAQ:IREN), a renewable-powered data center and Bitcoin (CRYPTO: BTC) mining company, may be significantly undervalued, according to a detailed “sum of the parts” (SOTP) analysis circulating on X, as highlighted by Eric Jackson, the founder of EMJ Capital.

Check out the current price of IREN stock here.

What Happened: Posted by ₿itcoin ₿utcher on Sunday, the analysis projects a staggering $300 per share valuation, implying a potential 1572.24% upside from its current price of approximately $18.00 apiece.

This bullish forecast has sparked interest among investors, with Jackson noting that “Now we're cooking with gas,” in his X post. This comes as Jackson had also pointed out in June that he was expecting the stock to soar over $100 apiece in the next 18 months.

The SOTP method, as outlined by the X user, breaks down IREN's value into three key revenue streams: colocation, Bitcoin mining, and cloud service provision.

The analysis assigns a $45.2 billion valuation to colocation, leveraging market comparables and a premium due to AI-driven demand, as inspired by insights from Gary Cardone‘s MiningPod interview with IREN CCO Kent Draper.

Bitcoin mining contributes $2.1 billion, derived from a comparison with another mining company, CleanSpark Inc. (NASDAQ:CLSK), while cloud services add $25.2 billion, capitalizing on IREN's air-cooled facilities in Childress in Texas, and Mackenzie in Canada.

"Building world-class data centers allows $IREN the flexibility to exercise multiple use cases," ₿itcoin ₿utcher wrote, emphasizing the company's strategic edge.

Despite the lack of peer-reviewed validation, the analysis suggests a potential 3x return, even if off by 80%.

IREN's diversified model positions it as a high-upside opportunity for risk-tolerant investors.

See Also: AAPL ‘Stock Would Soar’ If It Buys This, Says Jim Cramer: ‘Continued Buybacks Will Do Nothing’

Why It Matters: Jackson has been bullish on IREN and Cipher Mining Inc. (NASDAQ:CIFR) as he had highlighted in an X post earlier in July that these Bitcoin miners were undervalued.

Even as BTC hit fresh highs, he said that BTC miners — IREN and CIFR were “still priced like it’s (Bitcoin is) $58K."

Jackson underscored three points in their favour. IREN and CIFR have been;

- Cutting costs

- Increasing their exahashes per second

- Making a massive move into AI and high-performance computing (HPC) out of their BTC cash flow.

"The market just hasn’t caught up yet. I’m long," he added.

Price Action: IREN ended 0.61% lower at $17.94 apiece on Friday, and it was up 71.51% on a year-to-date basis and 54.92% over the past year. As of the publication of this article, Bitcoin was trading at $119,239.29 per coin.

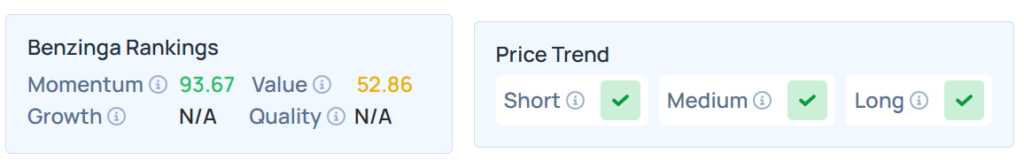

Benzinga Edge Stock Rankings shows that IREN had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, whereas its value ranking was moderate at the 52.86th percentile. Find More details about the mining stock here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended lower on Friday. The SPY was down 0.07% at $627.58, while the QQQ advanced 0.09% to $561.26, according to Benzinga Pro data.

On Monday, the futures of the S&P 500, Nasdaq 100, and Dow Jones indices were higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Antonio Gravante on Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News