Tom Lee Believes Strategy Could Become The Biggest Company If Bitcoin Hits $1 Million: Michael Saylor Is 'Changing The Reality' Of The Stock Market

Financial analyst Tom Lee predicted Tuesday that Michael Saylor-led Strategy Inc. (NASDAQ:MSTR) could become the largest company in the stock market, especially if Bitcoin (CRYPTO: BTC) hits $1 million.

MSTR stock tumbled in Tuesday’s session. Track it now here.

Strategy: The New Exxon Mobil?

During an interaction with podcaster Natalie Brunell, Lee said that Saylor is "changing the reality" of the stock market, steering a firm whose valuation is largely derived from its balance sheet, stacked up with Bitcoin, rather than net income.

"But that’s not new to history," The Fundstrat co-founder said. He remembered how Exxon Mobil Corp. (NYSE:XOM), which he said was valued solely on the value of oil, remained one of the top stocks in the market for nearly 30 years.

"For a whole generation people said Exxon was the biggest company but you don’t value on earnings," Lee said. "So Strategy is replacing Exxon in lower."

See Also: Strategy’s Options: A Look at What the Big Money is Thinking

Saylor Says Company‘s Capital Structure Smooth But…

Strategy has spearheaded Bitcoin’s corporate adoption, building a $70 billion reserve with proceeds from common stock, preferred stock and convertible bond issuances. The stock has soared in value since pivoting to a BTC treasury strategy.

Lee said last month that the astronomical jump in share price was due not just to the rise in BTC's value but also to the corporate maneuvers it adopted.

During the company's second-quarter earnings call, Saylor said that the company's structure is smooth and it can endure an 80% BTC drawdown.

However, the approach continued to face its share of criticism. Veteran short seller Jim Chanos suggests that the stock’s premium over Bitcoin’s value is not justified, and has adopted an arbitrage trade that involves shorting Strategy’s stock while buying Bitcoin.

Price Action: At the time of writing, BTC was trading at $113,677, down 0.86% in the last 24 hours, according to data from Benzinga Pro.

Shares of MSTR rose 1.41% in after-hours trading after closing 3.54% lower at $375.46 during Tuesday’s regular trading session.

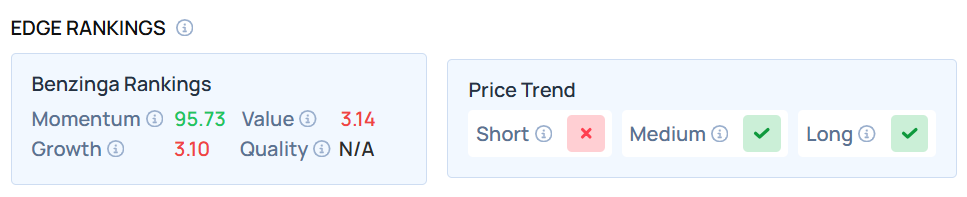

MSTR demonstrated a very high Momentum score—a measure of the stock's relative strength based on its price movement patterns and volatility over multiple timeframes—as of this writing. To find out how MSTR compares against the ‘Mag 7’ group of stocks, visit Benzinga Edge Stock Rankings.

Photo courtesy: PJ McDonnell /Shutterstock.com

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Jim ChanosCryptocurrency Short Sellers