Peter Schiff Says Gold Outperformed Bitcoin, Michael Saylor's Strategy Since Trump's Win — Here Is The Bigger Picture

Bitcoin (CRYPTO: BTC) and its proxy stock Strategy Inc. (NASDAQ:MSTR) have underperformed gold since President Donald Trump’s victory in November of last year, economist Peter Schiff highlighted on Tuesday.

Gold Outgains ‘Digital Gold’

In an X post, Schiff took the end of November as the reference point and highlighted the superior returns of gold and VanEck Gold Miners ETF (NYSE:GDX) vis-à-vis Bitcoin investments.

While he did not specify a date, for the sake of this analysis, let us fix Nov. 30 as the reference. Clearly, the returns are similar to what he highlighted.

Asset

Price (Recorded on Nov. 30, 2024)

Price (Recorded at 1:00 am p.m. ET)

Gains +/-

Bitcoin

$97,468.81

$113,677

+16.63%

Strategy Inc

$387.47

$375.46

-3.09%

Spot Gold

$2653.54

$3,372.62

+27%

VanEck Gold Miners ETF

$37.66

$56.46

+49.92%

Who’s The Winner On A Longer Timeframe?

Schiff, a vocal gold advocate, has long been accused of cherry-picking time frames according to his convenience to downplay Bitcoin's returns.

Popular Bitcoin-focused X handle The ₿itcoin Therapist dared Schiff to zoom out and compare the returns over the last 10 years.

Notably, the apex cryptocurrency has soared 42,934% in this period, while gold has returned only 208%.

Moreover, if we compare the yearly performance, Bitcoin and MSTR have netted returns of 102% and 174%, respectively, compared to 41% for gold.

Asset

Price (Recorded on Aug.6, 2024)

Price (Recorded at 1:00 am p.m. ET)

Gains +/-

Bitcoin

$56,040

$113,677

+102.84%

Strategy Inc

$136.92

$375.46

+174.21%

Spot Gold

$2381.53

$3,372.62

+41.61%

VanEck Gold Miners ETF

$35.63

$56.46

+58.46%

See Also: Michael Novogratz Says Bitcoin, Ethereum Treasury Frenzy May Be Over — What Now?

Is Bitcoin A Safe Haven?

However, the assertions were not entirely unfounded. Bitcoin, which has been marketed as a safe-haven investment by its supporters, struggled earlier this year due to Trump’s sweeping tariffs and behaved like a risk-on asset.

Gold, on the other hand, held to its inflation hedge tag, rallying while stocks and cryptocurrencies tumbled. Year-to-date, spot gold rose nearly 27%, while Bitcoin has gained 20%.

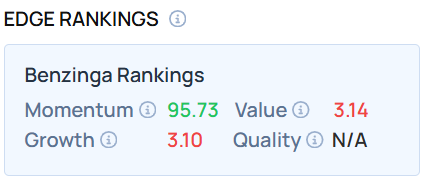

As of this writing, the MSTR demonstrated a very high Momentum score. Visit Benzinga Edge Stock Rankings to see how it compares with the VanEck Gold Miners ETF.

Photo Courtesy: seven xu on Shutterstock.com

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency