Gold Is Up 30% Year To Date But 'Could Be Ripe For A Correction': Analyst

Gold has been the crown jewel of 2025 so far, soaring more than 30% year to date and notching a fresh all-time high above $3,500.

But while bullion's safe-haven shine has dazzled amid economic and political chaos, one expert warns the rally may be running too hot.

"Gold surged to a fresh all-time high above $3500 before giving back some gains," said Lukman Otunuga, senior market analyst at FXTM. "While the fundamentals heavily favour bulls, technical indicators are showing that gold is heavily overbought and could be ripe for a correction."

From concerns over the Fed's independence — thanks to President Donald Trump's ongoing threats to fire Fed Chair Jerome Powell — to looming tariff shocks and recession fears, gold has become the escape hatch for jittery investors. Even a hawkish Fed and strong dollar haven't dented the momentum.

But overbought technicals may now be flashing yellow. "Depending on the intensity of the correction, prices may slip toward $3350, $3200, and $3140 before bulls jump back into the game. Conversely, a solid breakout and daily close above $3500 for Gold may pave a path to the next psychological level at $3600."

GLD Tracks Gold's Moves And May Feel The Whiplash

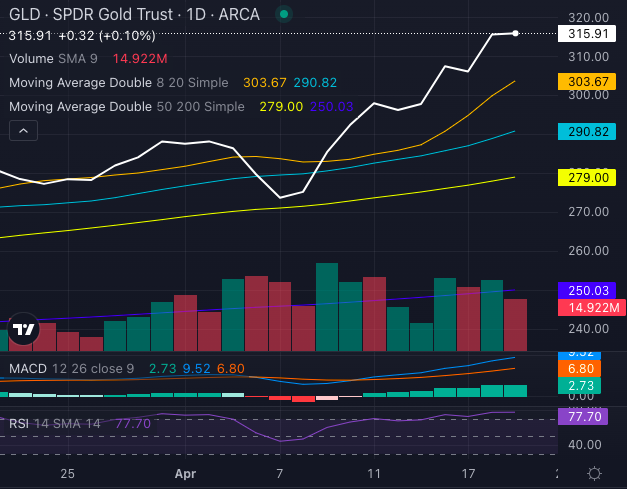

Chart created using Benzinga Pro

For equity investors, the SPDR Gold Trust (NYSE:GLD) is one of the most widely used proxies for gold. And it’s closely tracking the metal's moves — GLD is up sharply year-to-date, riding the gold wave higher. But if bullion takes a breather, miners could take a sharper hit due to operating leverage.

Its Relative Strength Index (RSI), also overbought at 77.70 — suggesting a correction may be up next.

As gold teeters near a potential pullback, investors using GLD as a gold play may want to tread lightly. A cooling in gold prices – even if temporary – could send gold mining stocks lower soon, even if the longer-term thesis for safe-haven demand remains intact.

Read Next:

Image: Shutterstock

Latest Ratings for GLD

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Apr 2013 | Oracle Investment Research | Initiates Coverage On | Strong Buy | |

| Apr 2013 | Oracle Investment Research | Initiates Coverage On | Strong Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas Macro Economic Events Specialty ETFs Technicals Commodities Top Stories Economics