Cathie Wood Goes On A $20M Bitmine Immersion Bargain Hunt As Ark Trims Robinhood And Palantir Stakes

On Monday, Cathie Wood-led Ark Invest made significant trades, including a notable purchase of Bitmine Immersion Technologies Inc. (BMNR) shares. The investment firm also increased its holdings in Alphabet Inc. (NASDAQ:GOOG) and NVIDIA Corp (NASDAQ:NVDA), while reducing its stake in Robinhood Markets Inc. (NASDAQ:HOOD) and Palantir Technologies Inc (NASDAQ:PLTR).

The Bitmine Trade Ark Invest made a substantial investment in Bitmine Immersion through Ark Fintech Innovation ETF (BATS:ARKF), ARK Innovation ETF (BATS:ARKK), and ARK Next Generation Internet ETF (BATS:ARKW). This strategic move follows Bitmine’s announcement that its Ethereum (CRYPTO: ETH) holdings have exceeded $2 billion.

The total purchase of 573,853 shares by Ark Invest reflects confidence in Bitmine’s Ethereum treasury strategy. The investment is valued at approximately $20.1 million, based on the latest closing price of $35.11. Notably, it was reported earlier that Ark poured $175 million into Bitmine Immersion stock.

Notably, shares of Bitmine Immersion Technologies fell 15.1% in after-hours trading on Monday after it filed a shelf registration for securities resale by existing stockholders. The move was seen as dilutive, despite the company potentially raising $25.18 million if warrants are exercised.

The Alphabet Trade Ark Invest’s ARKW ETF acquired 181,640 units of Alphabet’s Class C stock on Monday. This purchase comes amidst ongoing scrutiny of Google’s search monopoly, with a judge’s ruling anticipated soon. Despite these challenges, analyst Doug Anmuth maintains an Overweight rating on Alphabet, with a price target of $232. The value of Ark’s investment in Alphabet is approximately $35.1 million as the stock ended the day at $193.42.

The NVIDIA Trade Ark Invest’s ARK Autonomous Technology & Robotics ETF (BATS:ARKQ) and ARK Space Exploration & Innovation ETF (BATS:ARKX) increased their holdings in the Jensen Huang-led chipmaker by purchasing a combined total of 27,124 shares. NVIDIA recently reached a $4 trillion market cap, but analysts caution that its AI growth may be constrained by energy infrastructure limitations. The total value of Ark’s NVIDIA purchase is approximately $4.8 million. On Monday, Nvidia stock ended the day at $176.75.

The Robinhood Trade Ark Invest reduced its position in the retail-oriented trading platform by selling 119,090 shares across its ARKF and ARKW ETFs. The sale is valued at approximately $12.7 million. It should be noted that Wood has been trimming Ark’s Robinhood holdings recently and sold $11.5 million worth of stock last week as well.

The Palantir Trade saw Ark Invest selling shares of Palantir across its ARKF and ARKW ETFs. On this day, the firm sold 17,583 shares from ARKF and 44,002 shares from ARKW. The transaction was valued at $9.7 million as the stock closed at $157.88 for the day.

This decision aligns with a period of heightened interest in Palantir, as the stock recently hit an all-time high of $160.39, driven by a new Overweight rating from Piper Sandler with a $170 price target. Palantir’s stock has been on a remarkable upward trajectory, with market experts like Jim Cramer predicting further gains, potentially reaching $200.

Other Key Trades:

- Sold 134,833 shares of Block Inc (XYZ) from ARKK, 43,003 shares from ARKW and 8581 shares from ARKF valued at approximately $15 million.

- Sold 43,479 shares of CRISPR Therapeutics AG (CRSP) from ARKG.

- Bought 227,594 shares of Veracyte Inc (VCYT) from ARKK.

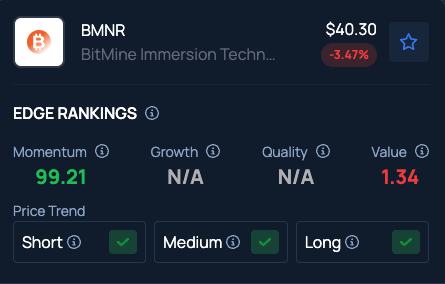

Benzinga's Edge Stock Rankings indicate BMNR checks out on Short, Medium and Long Price Trends. Here is how the stock fares on other metrics.

Photo Courtesy: ChrisStock82 on Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.