These Network And Cable TV Channels Are Getting Hit Hardest In 2016

Neilson recently released C3 ratings through the end of May, and Goldman Sachs analyst Drew Borst took a look at how TV ratings are holding up and which companies are getting hit hardest by cord-cutting.

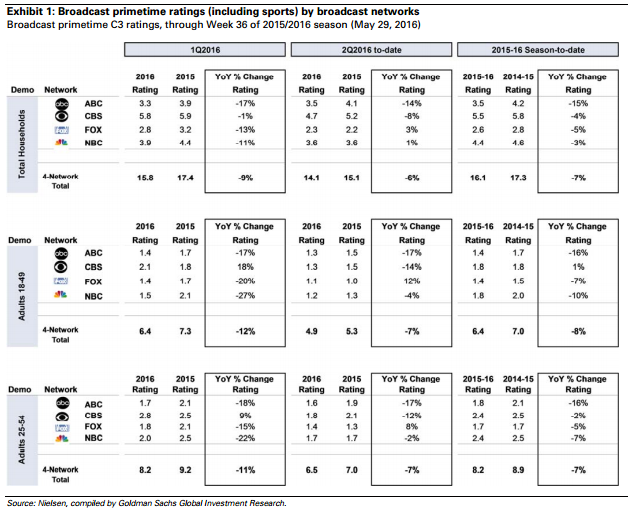

Through the ninth week of Q2 2016, prime-time broadcast ratings for the 18–49 demographic are down 7 percent year-over-year (Y/Y).

In terms of total household broadcast ratings in the 2015–2016 season, Walt Disney Co (NYSE: DIS)’s ABC (-12 percent) has been hit hardest followed by Twenty-First Century Fox Inc (NASDAQ: FOXA)’s FOX (-5 percent), CBS Corporation (NYSE: CBS)’s CBS (-4 percent) and Comcast Corporation (NASDAQ: CMCSA)’s NBC (-3 percent).

When it comes to cable, Twenty-First Century Fox is the big winner. Led by Fox News Channel’s 21 percent year-over-year ratings gain, Fox’s cable networks are averaging an 8 percent year-over-year ratings gain in 2016.

Scripps Networks Interactive, Inc. (NASDAQ: SNI) (+3 percent) and AMC Networks Inc (NASDAQ: AMCX) (+0 percent) are the only other companies not to log overall ratings declines so far in 2016.

The biggest cable ratings losers so far this year are Disney (-9 percent), Discovery Communications Inc. (NASDAQ: DISCA) (-7 percent) and Comcast (-7 percent).

The U.S. presidential election coverage has clearly provided a boost to cable viewership so far this year. Given their rankings last year, the three cable channels with the highest 2016 ratings surges are Comcast’s MSNBC (+59 percent), Time Warner Inc (NYSE: TWX)’s CNN and Viacom, Inc. (NASDAQ: VIAB)’s VH1 (+33 percent).

Disclosure: The author holds no position in the stocks mentioned.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: ABC CBSEducation Politics Tech Media Trading Ideas General Best of Benzinga