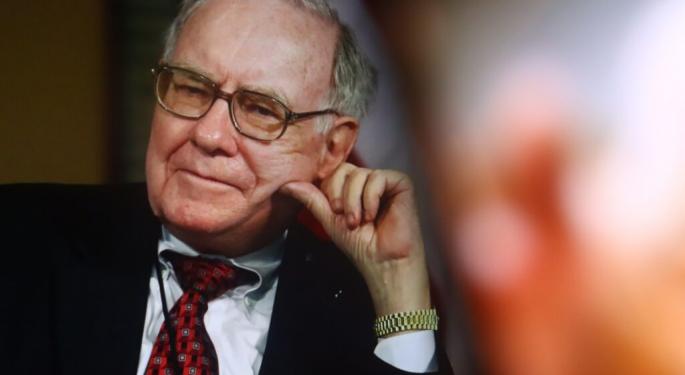

Warren Buffett Once Said Business Schools Teach 'The Silliest Stuff'—And This Is What He And Charlie Munger Would Do Instead To Train The Next Generation Of Leaders

Berkshire Hathaway CEO Warren Buffett and former vice chairman Charlie Munger's distaste for fancy degrees and business schools is well known. At the 2012 Annual Meeting, a Master of Business Administration student asked them what they considered the right way to train business leaders.

What Happened: In response, Buffett labelled much of what is taught in top-tier business schools as “the silliest stuff,” particularly in the field of investing. "It is astounding to me how the schools have focused on sort of one fad after another in finance theory. And it’s usually been very mathematically based," he said.

He observed that the pressure to move up through the ranks frequently compels faculty members to conform rather than disrupt the status quo: "Going against the revealed wisdom of your elders—it can be very dangerous to your career path at major business schools."

Instead of technical models like modern portfolio theory or option pricing, Buffett said students should be made to take only two courses: "I would have a course on how to value a business, and I would have a course on how to think about markets."

Why It Matters: Buffett reiterated his belief that the core of investing lies in understanding business value, not abstract models. "If you buy businesses for less than they’re worth, you’re going to make money," he said. He also highlighted how crucial it is to recognise which businesses can be accurately valued.

He illustrated this disconnect between real-life situations and textbook knowledge by referencing Ray Kroc, the founder of McDonald’s, saying, "When Ray Kroc started McDonald's, he was nothing but the option value of what the McDonald's stock might be or something. He was thinking about whether people would buy hamburgers".

Munger added that accounting, too, has become subject to such thinking, criticizing the common use of the Black-Scholes model. "They want some kind of a standardized solution that requires them not to think too hard. And they have one," he said

Read Next:

Image Via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Charlie Munger Warren BuffettEducation General