Guess? Expected To Deliver Worst Quarter In Years

Guess?, Inc. (NYSE: GES) is scheduled to announce Q1 2016 financial results, scheduled for after the market closes on Tuesday. According to Estimize, expectations point towards the weakest earnings in years.

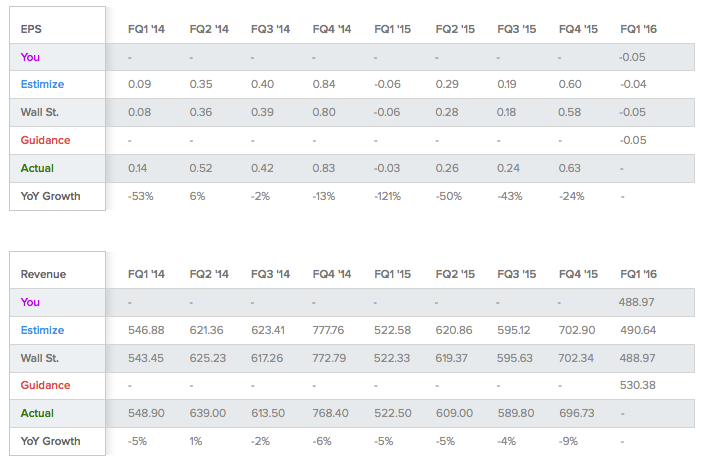

The company’s earnings respond to a cycle, peaking in the fourth quarter and hitting a bottom in the first quarter. In the first quarter last year, Guess reported a net loss of $(0.03) on revenue of $522.5 million. In the last quarter, earnings came in at $0.63 per share, and revenue, at $696.73 million.

Below is a table featuring the company’s history of estimates and earnings for the past couple of years.

For the current quarter, the company guided a net loss of $(0.05) on revenue of $530.38 million. The Street is modeling a loss in line with guidance, but on lower revenue of $488.97 million. The crowd is slightly less bearish, and projects a consensus net loss of $(0.04) on revenue of $490.64 million.

It should be noted in the graph overhead that Guess has a history of surpassing estimates.

Institutional Support

Only two research firms have weighed in on the stock this year: Piper Jaffray downgraded it to Underperform in February and Jefferies reiterated a Hold in March.

Hedge funds and other institutional investors seem to be into the stock. According to recent SEC filings, over the first quarter of 2015, Joel Greenblatt’s Gotham Asset Management more than doubled its exposure, to 2,680,779 shares worth almost $50 million; Jim Simons’ Renaissance Technologies sextupled its wage to 1,022,900 shares; and Ken Griffin’s Citadel Advisors tripled its bet, disclosing ownership of 566,509 shares as of March 31.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: citadel advisors Estimize Gotham Asset Management JefferiesPreviews Crowdsourcing Trading Ideas General