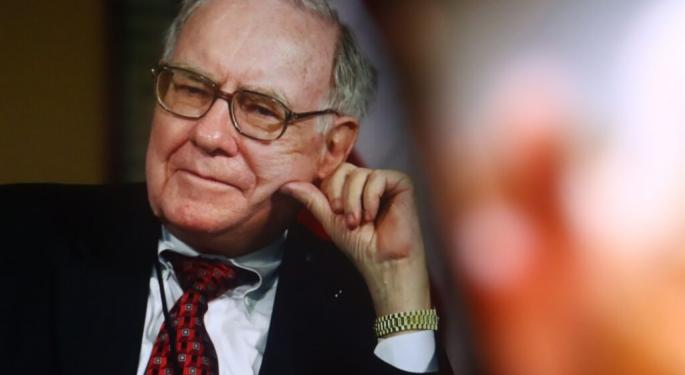

Warren Buffett Shows How Patience Pays: 98% Of His $160 Billion Wealth Came After Turning 65, Thanks The Power Of 'Compound Interest'

According to the recent data shared by Creative Planning, Inc., the ‘Oracle of Omaha,’ Warren Buffett earned 98% of his current net worth after turning 65 years old.

What Happened: The 94-year-old veteran investor Buffett has a net worth of $160 billion according to Bloomberg’s Billionaire Index.

Peter Mallouk, the president and CEO of Creative Planning, shared data showcasing that the ace investor’s net worth stood at $3 billion nearly 34 years ago, when he was just 65.

His wealth has compounded by nearly 5,233% since then to $160 billion as of May 14. This shows that he earned 98% of his wealth after the age of 65.

Mallouk also quoted Buffett, highlighting that the growth in his wealth was possible through the power of compounding.

“My life has been a product of compound interest,” Buffett once said.

Why It Matters: Buffett holds his investments via the holding company, Berkshire Hathaway Inc. (NYSE:BRK) (NYSE:BRK), which is headquartered in Omaha, Nebraska.

Known to be one of the best portfolio managers of all time, Buffett, via Berkshire, holds major investments in Apple Inc. (NASDAQ:AAPL), American Express Co. (NYSE:AXP), Bank of America Corp. (NYSE:BAC), and Coca-Cola Co. (NYSE:KO).

BRK has returned 13.47% this year so far, while SPY is up 0.13%. This, as Berkshire is sitting on a cashpile worth $348 billion as of the first quarter of 2025.

Price Action: As of Tuesday, BRK closed -0.47% lower at $511.88 apiece. The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended on a positive note on Tuesday. The SPY was up 0.66% to $586.84, while the QQQ advanced 1.52% to $515.59, according to Benzinga Pro data.

On Wednesday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading slightly above the flatline.

Read Next:

Image Via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Equities Market Summary News Broad U.S. Equity ETFs Futures Markets ETFs General