TSLA Stock Jumps In Friday Premarket As Wedbush's Dan Ives Raises Price Target To $500, Citing 'Golden Age Of Autonomous' Vehicles

Renowned tech bull Dan Ives has significantly raised his price target for Tesla Inc. (NASDAQ:TSLA) to $500, signaling a strong bullish outlook driven by the imminent arrival of what he terms the “golden age of autonomous” vehicles.

What Happened: Ives conveyed his updated stance via an X post, emphasizing the pivotal role of upcoming developments for the electric vehicle giant.

“We believe the golden age of autonomous is now on the doorstep for Tesla with the Austin launch next month kicking off this key next chapter of growth for Musk & Co.,” stated Ives.

His revised price target reflects an anticipation of substantial future value creation for the company. “we are raising our price target to $500 reflecting this massive stage of valuation creation ahead,” Ives added, underscoring the profound impact he expects autonomous technology to have on Tesla’s market capitalization.

The price target for the company stood at $350 per share before the update, thus representing a 42.85% increase.

The “Austin launch” next month appears to be a key catalyst in Ives’ assessment, suggesting that the expansion of Tesla’s autonomous capabilities and related initiatives from its Austin facility will be a major driver of this new growth phase for Elon Musk‘s enterprise.

Why It Matters: According to Benzinga Pro, Tesla shares are trading at a price nearly 158.730 times its 2026 earnings. At the same time, the average forward price-to-earnings of its peers stood at 25.75 times, implying that Tesla was 6.16 times more expensive than its industry’s average.

The shares were down 10.08% year-to-date, but it has returned by 36.01% just in the last month. TSLA was up 96.29% over the year. On Thursday, it ended 1.92% higher, and it advanced 1.40% in premarket on Friday.

Meanwhile, the SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were flat in premarket on Friday. The SPY was down 0.026% to $583.00, while the QQQ declined 0.099% to $513.52, according to Benzinga Pro data.

TSLA has a consensus ‘hold’ with a consensus price target of $292.93, according to the 27 analysts tracked by Benzinga. The targets range from $19.05 to $500. Recent ratings by Mizuho, Wedbush, and Guggenheim suggest a $303.33 target, implying a 12.26% downside.

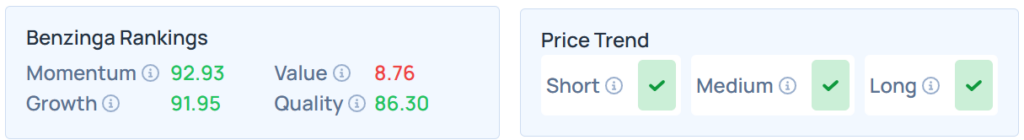

Benzinga Edge Stock Rankings shows that Tesla had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, however, its value ranking was poor at the 8.76th percentile. The details of other metrics are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Equities Market Summary News Broad U.S. Equity ETFs Futures Markets Analyst Ratings