The Analyst Verdict: Magnolia Oil & Gas In The Eyes Of 7 Experts

In the last three months, 7 analysts have published ratings on Magnolia Oil & Gas (NYSE:MGY), offering a diverse range of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 3 | 0 | 1 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 1 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 1 |

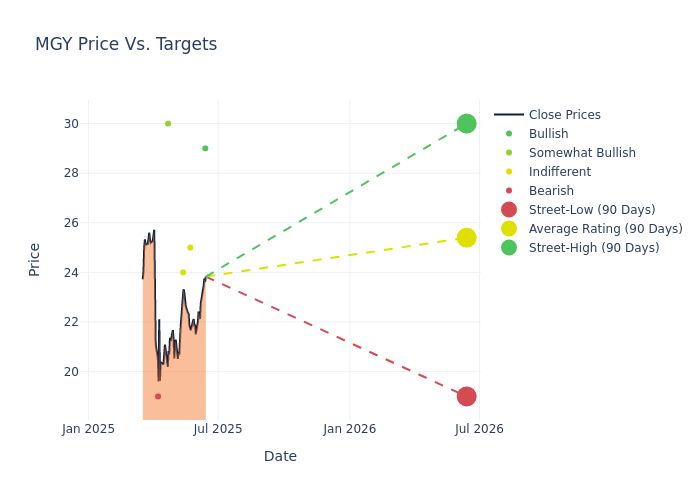

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $25.43, along with a high estimate of $30.00 and a low estimate of $19.00. Experiencing a 0.27% decline, the current average is now lower than the previous average price target of $25.50.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Magnolia Oil & Gas among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Peyton Dorne | UBS | Raises | Buy | $29.00 | $26.00 |

| Noah Hungness | B of A Securities | Raises | Neutral | $25.00 | $23.00 |

| Mark Lear | Piper Sandler | Lowers | Neutral | $24.00 | $25.00 |

| Biju Perincheril | Susquehanna | Lowers | Positive | $30.00 | $31.00 |

| Mark Lear | Piper Sandler | Lowers | Neutral | $25.00 | $26.00 |

| Peyton Dorne | UBS | Announces | Buy | $26.00 | - |

| Paul Diamond | Citigroup | Lowers | Sell | $19.00 | $22.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Magnolia Oil & Gas. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Magnolia Oil & Gas compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Magnolia Oil & Gas's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Magnolia Oil & Gas's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Magnolia Oil & Gas analyst ratings.

Discovering Magnolia Oil & Gas: A Closer Look

Magnolia Oil & Gas Corp is an independent oil and natural gas company engaged in the acquisition, development, exploration, and production of oil, natural gas, and natural gas liquid (NGL) reserves. The company's oil and natural gas properties are located in Karnes County and the Giddings area in South Texas, where the Company targets the Eagle Ford Shale and Austin Chalk formations. Its objective is to generate stock market value over the long term through consistent organic production growth, high full-cycle operating margins, and an efficient capital program with short economic paybacks. The company's operating segment is acquisition, development, exploration, and production of oil and natural gas properties located in the United States.

Understanding the Numbers: Magnolia Oil & Gas's Finances

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Magnolia Oil & Gas's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 9.67%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Energy sector.

Net Margin: Magnolia Oil & Gas's net margin excels beyond industry benchmarks, reaching 28.92%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Magnolia Oil & Gas's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.27% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Magnolia Oil & Gas's ROA excels beyond industry benchmarks, reaching 3.56%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.21, Magnolia Oil & Gas adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for MGY

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Keybanc | Maintains | Overweight | |

| Mar 2022 | Keybanc | Maintains | Overweight | |

| Jan 2022 | Keybanc | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings