Expert Outlook: Couchbase Through The Eyes Of 14 Analysts

14 analysts have shared their evaluations of Couchbase (NASDAQ:BASE) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 5 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 2 | 0 | 0 |

| 1M Ago | 3 | 3 | 2 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

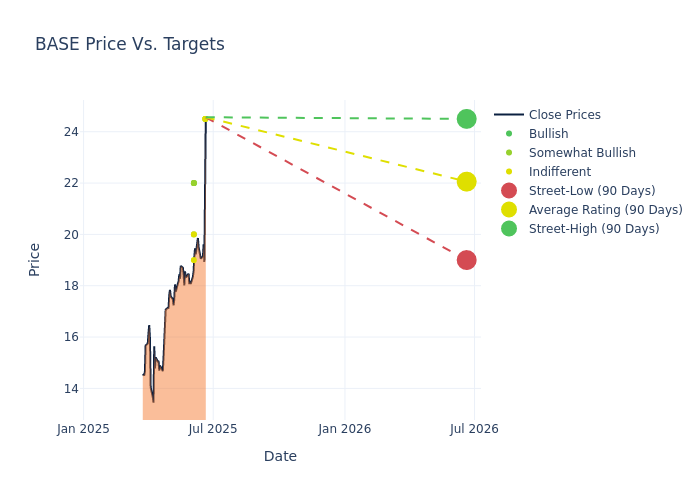

Analysts have recently evaluated Couchbase and provided 12-month price targets. The average target is $21.04, accompanied by a high estimate of $24.50 and a low estimate of $16.00. This upward trend is apparent, with the current average reflecting a 1.3% increase from the previous average price target of $20.77.

Deciphering Analyst Ratings: An In-Depth Analysis

A comprehensive examination of how financial experts perceive Couchbase is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Blair Abernethy | Rosenblatt | Raises | Neutral | $24.50 | $22.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $24.50 | $22.00 |

| Rudy Kessinger | DA Davidson | Lowers | Neutral | $24.50 | $25.00 |

| Sanjit Singh | Morgan Stanley | Raises | Equal-Weight | $19.00 | $18.00 |

| Matthew Hedberg | RBC Capital | Maintains | Outperform | $22.00 | $22.00 |

| Austin Dietz | UBS | Raises | Neutral | $20.00 | $18.00 |

| Rob Oliver | Baird | Raises | Outperform | $22.00 | $20.00 |

| Blair Abernethy | Rosenblatt | Raises | Buy | $22.00 | $20.00 |

| Mike Cikos | Needham | Maintains | Buy | $22.00 | $22.00 |

| Brent Bracelin | Piper Sandler | Raises | Overweight | $20.00 | $16.00 |

| Blair Abernethy | Rosenblatt | Maintains | Buy | $20.00 | $20.00 |

| Brent Bracelin | Piper Sandler | Lowers | Overweight | $16.00 | $22.00 |

| Sanjit Singh | Morgan Stanley | Lowers | Equal-Weight | $18.00 | $23.00 |

| Blair Abernethy | Rosenblatt | Announces | Buy | $20.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Couchbase. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Couchbase compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Couchbase's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Couchbase's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Couchbase analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Couchbase

Couchbase Inc provides a modern cloud database that offers the robust capabilities required for business-critical applications on a scalable and available platform. It empower developers and architects to build, deploy and run mission-critical applications. Couchbase delivers a high-performance, flexible and scalable modern database that runs across the data center and any cloud. Geographically, the company generates a majority of its revenue from the United States.

Couchbase's Economic Impact: An Analysis

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, Couchbase showcased positive performance, achieving a revenue growth rate of 10.12% as of 30 April, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Couchbase's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -31.28%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Couchbase's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -13.93%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Couchbase's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -6.97%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Couchbase's debt-to-equity ratio is below the industry average. With a ratio of 0.03, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for BASE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Barclays | Maintains | Overweight | |

| Mar 2022 | Stifel | Maintains | Buy | |

| Mar 2022 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings